The Diamond drought

6.8 k views | By Nick Lord

6.8 k views | By Nick Lord

Fifteen years of fruitless exploration and a lack of large stones have renewed concerns of an impending diamond supply shortage that could see prices rise and retailers left out in the cold… unless they act now. NICK LORD reports.

For decades, industry doomsayers have professed a future where diamonds will be scarce in supply. It's as popular a topic for keynote speakers at diamond conferences as consumer confidence or synthetic stones, but also an issue to which no one seems to be able to give a definitive answer. Is the world running out of diamonds?

Considering the immense time needed for the earth to create just one - and the speed in which they're being gobbled up - it's a reasonable assumption that, eventually, there'll be no more stones. But surely that day remains many moons away, right?

Perhaps not, if presentations at last November's World Diamond Conference in Perth are any indicator. There, speakers drew attention to the widening gap between current world production levels, which are tipped to fall in coming years, and the insatiable demand of emerging new economies India and China.

First to prophesise bleak times ahead was South African diamond analyst James Allen, James Allen and Associates.

Allen postulated evident shortfalls in supply by 2008, increasing to 2010, stating,

"Demand growth for diamonds over the next five years will be equivalent in value to around $US4-5 billion; however, the diamond supply shortfall amounting to a value of around $US3 billion will start kicking in by 2008 and be fully evident by 2010."

Such a shortfall, continued Allen, will only be exasperated further "by declining South African production, reductions in diamond exploration spending and short-sighted efforts by some producers to focus on near-term mine development pipelines."

Allen certainly isn't the only one predicting almost immediate supply shrinkage; in fact, that line of argument has been quite popular among industry analysts since WH Ireland's James Picton first declared in a 2002 presentation, "Rough diamond demand is expected to grow 6 per cent a year to $US23 billion by the year 2015, up from $13.4 billion in 2005. Prices will rise by one-third and, by 2015, there will be a shortfall of $10 billion of unfulfilled demand."

In his address to the conference, North Australia Diamonds chairman Ewen Tyler also forecast supply issues, but instead circumvented the rising demand argument to cite a different challenge: the absence of exploratory desire.

Tyler lamented lengthening research delays at potential new sites, saying, "The reason for the non acceleration of discovery is that the excitement of discovery has been lost to men and women in the field by the time something of interest transfers from geologists to the field camp to the laboratory.

Calling for the reprioritisation of available funds into exploration and the maximisation of existing sites, Tyler stressed, "The sector needs to question whether its exploration search effort is relying too much on new technology, rather than tried and tested diamond exploration ways of the past."

The supply argument is riddled with speculation. With so much of the earth's crust unmined, it's impossible to give anything but a loose approximation of the diamonds that may appear, based on average site yields and the number of new mines due to commence production in the ensuing decade. Therefore it is as difficult to supplement arguments of supply shortages as it is to fuel hope that there are more diamonds available.

One thing is certain: if predictions such as those from Allen, Picton and Tyler are correct, the trade will be forced to adjust even further that it is already for dramatically escalated prices - something retailers and suppliers are already battling to control.

"The immediate impact will be upward pressure on rough diamond prices rising to balance the market shortfalls between 2008 and 2010," Allan proclaimed in his presentation. "These rises will be in addition to the 35 per cent rough diamond price rise evident since 2002."

Cold, hard data

According to estimates from De Beers, the global production of diamonds in 2005 yielded some 160 million carats, with a (rough) value of $US13.4 billion. De Beers is still the biggest fish by a long shot, but no longer does it pose the monopoly it once did, producing 48 per cent of global production by value ($US6.54 billion) and just 30 per cent by volume (49 million carats).

Rio Tinto, BHP Billiton, the Lev Leviev Group and the Steinmetz Group are just four of a handful of companies now competing strongly with De Beers thanks to the emergence of major discoveries outside traditional De Beers strongholds in Botswana, South Africa, Tanzania and Namibia. Worryingly, none of these discoveries seem large enough to compensate for any loss of yield in any of these sites, nor in Russian or Australian mines.

Botswana, for example, is the world's leading diamond producer (in terms of value), yet the Botswana government recently released estimations of a 10 per cent reduction in production. Production has also fallen slightly in Namibia (5 per cent in the past year).

Furthermore, De Beers' decision to close its mines in the Kimberley region at the end of 2005 is sure to affect global yield with the three mines there previously responsible for over 2 million carats annually.

"The Kimberley mines are exhausted," former De Beers managing director Gary Ralfe told Reuters in June. "They have been going for over 100 years."

Making matters worse, Kimberley isn't the only site drying out. Russian mining giant Alrosa experienced a drop in production from 35 million carats in 2004 to 23 million carats in 2005, a fall of approximately 30 per cent. The reduction has been blamed on the depletion of open pit mines in the previously productive Yakutia region.

Speculation also surrounds the profitability of Australia's own Argyle mine, the world's largest producing mine for small goods - diamonds under two carats. Faced with closure of the open pit in 2007, Rio Tinto instead invested over $1 billion in a last-gasp decision to develop an underground mine to extend production until 2018, albeit at annual return estimates of just 60 per cent of previous annual yields.

As the open pit has reached its depth and width limits, Argyle's domestic diamond production has already dropped 22 per cent, according to the Australian Bureau of Agricultural and Resource Economics (ABARE), yielding just 25 million carats in 2005-2006.

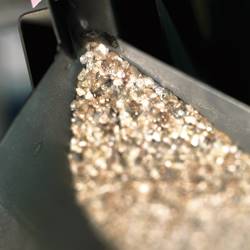

Rough Argyle diamonds

While these statistics paint a grim picture, the trade remains hopeful that newcomer Canada can pick up the slack, steadying global supply in the process. Already the third largest diamond producer by value, Canada has two new mines due to commence production in 2009 and, more importantly, the country is undergoing a heavy exploration phase, indicating there is still hope for further discovery. Rio Tinto also remains optimistic, deflecting current supply figures as not indicative of total production possibilities. "While supply for the next 10 years is likely to deviate from an historical growth trend, it is a long way off drying up," says Jean Marc Lieberherr, general manager marketing, Rio Tinto Diamonds.

"Rough diamonds are presently mined in 25 countries around the world from underground, open cut and offshore sites. The long term supply outlook is dependent not only on existing production, but also on existing projects not yet in production, and new projects not currently discovered. It should also be noted that diamond exploration expenditure has increased dramatically over the last few years and this trend is likely to continue."

Argyle managing director David Rose also dismisses supply concerns: "Rio Tinto's estimates of diamond supply indicate that it's likely to stay relatively constant over the next ten years," Rose says. "Rio Tinto estimates the total value of 2005 world diamond production to be approximately $US12.9 billion. This is a marginal increase over 2004 supply and reflects an increased output from the Argyle operation and other mines."

But demand keeps rising

Worldwide diamond sales today account for over $70 billion, up from just $20 billion in 1983, and demand for diamonds already outweighs supply. Do you have figures for that? Like demand outweighs supply by how much?

Astonishingly, a recent Gem and Jewellery Export Promotion Council of India and KPMG report titled The Global Gems and Jewellery Industry: Vision 2015: Transforming for Growth, is forecasting total jewellery sales to treble by 2015.

"Worldwide jewellery sales will grow 4.6 per cent per year to reach $185 billion in 2010 and $230 billion in 2015," the report states.

China's rough diamond sales alone are expected to grow at a rate of 15-20 per cent annually, and jewellery sales soar by 40 per cent, as Shanghai strengthens as a key trading centre.

It's this growing demand, and the corresponding stress upon supply, that has caused wholesale prices to jump since 2003. Just last year, De Beers raised rough prices twice for a total increase of 9.5 per cent.

Now, if forecasts for retail diamond demand are correct - with analysts predicting a five per cent rise every year for the next decade - then the trade would require an additional $500 million of diamond production in each of those years to meet the increasing demand.

This isn't going to happen, according to the experts. Even if new mines were found, the lengthy period of evaluation and development that mines experience between their initial discovery and their first yield can mean diamonds don't appear on the market for up to a dozen years.

Tyler's call for a significant increase in exploration is indeed a pertinent one; however, any exploration may now be too late to stop incidental price hikes between now and 2016.

"Prices will go up," says leading diamond exploration gemmologist Bram Janse. "It takes eight to 12 years to get production from a new discovery mine and there are no discoveries at present to make up the impending shortfall."

Batton down the hatches

Undoubtedly the largest challenge to retailers in the coming decade will be how to ensure a stable supply of diamonds; however, many don't seem all that concerned at present.

"I'm not aware of any major diamond shortages at this stage," says Travis Trewarne, director of Melbourne diamond retailer Trewarne Fine Jewellery. "As I see it, there are still a few mines yet to come online so I don't expect supply line issues in the short to medium term (10 - 15 years). Beyond that, any diamond scarcity will be reflected by an increase in value for what's left over."

Despite his optimism, Trewarne admits the issue of supply is already a challenge in certain sizes and shapes, a factor he attributes to a rise in real wage levels over the past decade.

"Any supply issues are usually specific to a particular type, size and quality of diamond. At the moment, for example, there is a shortage of diamonds over one carat. An increase in the average wealth of the global population means people are now able to afford larger stones and so the industry is having problems supplying in that size."

With it becoming harder to source particular stones, the importance of retailers developing relationships with diamond wholesalers who have access to reliable supply lines cannot be understated.

It's only as the market tightens that the true significance of existing relationship management initiatives such as De Beers' Supplier of Choice program is fully understood.

As explained on the De Beers website: "The objective of Supplier of Choice is to drive demand for diamonds and diamond jewellery by objectively and fairly selecting clients according to the extent to which they are aligned with Supplier of Choice objectives. Once selected, sightholders have available to them numerous marketing and other opportunities which enable them to capitalise on the DTC's expertise and experience in the industry."

In short, suppliers have to play by De Beers' rules if they want De Beers' diamonds, creating a relationship with the group that is mutually beneficial. It's about trust, integrity and confidence, but most of all, it's about getting diamonds. And, though De Beers may be leading the revolution, relationship management is quickly becoming a crucial part of dealings between even local suppliers and retailers.

"We create, foster and go to great effort to develop long term, mutually beneficial business relationships with retailers," says Lonn Miller, director, Miller Diamonds, adding that such relationships are often to the benefit of the market as a whole because they ensure certain behavioural requirements and standards are met by both parties.

Rough Argyle Diamonds

"Usually in business, one has the luxury of choosing with whom to deal. We sell a certain kind of product so we look for a certain calibre of jeweller to build meaningful long-term relationships with, and we put in the extra effort supplying unsurpassed support for retailers who respond in kind."

Storch and co. is another diamond supplier that insists its customers meet certain established criteria. According to director Daniel Storch, relationship management has existed in some form between suppliers and producers for decades, so it was only a matter of time before it was applied to retail dealings: "By having an established relationship with our own supplier for over 50 years, we're still able to get those types of goods that are experiencing shortages at the moment, (like diamonds over a carat). And from here, we naturally give preference to those retailers who are supporting us and the marketplace - loyal customers, rather than brand switchers who don't buy stock but instead sell from apro goods."

Building such relationships is the only way to ensure supply in the coming years, Storch adds: "The Australian trade is very lucky. We have a couple of wholesalers with good overseas relationships so retailers are privileged in the quality of diamonds they can get here. Even with the arrival of internet and other distribution channels, these supplier-retailer relationships are the only real way to get the best deals and not just the run of stock goods. The best diamonds never hit the shop window. They go straight to a preferred retailer who offers them to his special customers."

While these types of preferred relationships aren't out of reach for the independent, single-store jeweller, Storch admits there is a misconception that suppliers use supply relationships to instil certain requirements such as cob-operative advertising that will lower the supplier's own costs.

"Retailers need to look at how they can work together with their suppliers for the best interests of all involved. And that means seeing us as a tool for their business and not an adversary. We're not in competition. We don't deal to public. We want to see stores strengthen their business so they purchase more from us."

Of course, in the race to develop these relationships, there will be losers. It's no great prediction to suggest that fewer people will be able to make a living out of diamonds in the future, or that retailers and suppliers have to be better organised. But there will probably also be a shift in the way jewellers and diamond retailers operate, especially at the independent level.

As access to stones tightens, consumers will no longer be able to enter any jeweller to get a diamond, and those retailers who are unable to purchase an inventory of stones themselves will need to concentrate upon creating a point of difference through quality manufacture and design of end product, thus providing a better "whole package".

Alternately, retailers can choose to stock different goods. It's not implausible to consider a shift in operations from single-store independents away from diamonds.

"I wonder if a lot of those smaller stores aren't actually shrinking their diamond segment," suggests Garry Holloway, director of Melbourne retailer Precious Metals. "Because diamonds are only going to make up 10 - 20 per cent of their sales, where they may historically have made up more than 30 per cent, we might end up seeing a lot more fashion jewellery."

Holloway is quick to assert once again that this is no time for retailers to panic. The industry isn't going to run out of diamonds overnight, but retailers should heed the warning and at least begin thinking about their options.

"As to whether you're going to wake up tomorrow and say you must form relationships, it's probably not quite that severe. It's a gradual evolution in which jewellers should be planning for what they want to happen, rather than be left asking what happened," he says, adding that the supply challenge has less to do with the number of physical diamonds and more to do with controlling escalations in market price.

"You can always get diamonds," Holloway continues. "Whether you're going to get them at viable prices is the main issue. A consumer can buy a diamond online for eight per cent more than it is listed on [diamond price indexes] Rapaport or Idex. Eventually, it may be just as cheap for some retailers to buy diamonds from a consumer website as from a wholesaler.

Miller, as a supplier, also believes diamonds will continue to be available for those who are seen to be using them correctly. For retailers, and distributors alike, this means those who nurture the market by adding value.

"We may run out of diamonds, but it's not going to happen in my lifetime, or my kid's lifetime, or their kid's lifetime at least. As is already evident, what will happen is that it will be a problem getting the right goods at the right time and at the right price unless you have relationships with good producers like De Beers, Alrosa etc.

"So long as a one has access to a major producer, supply will be alright but the market has changed. It's no longer just a question of buying a polished diamond and selling it. You now really need a super-efficient distribution system (at supply level) and to add value (at retail level) or there will be someone who can do it better than you."

Should there be no new discoveries, then it's a certainty that prices will rise. Ultimately, such a change will again force retailers to become more efficient, better at adding value to their product and better at building established relationships with their suppliers. Only through these steps will they ensure they get the stones they need.

Posted February 01, 2007