Rough is the lifeblood of the gemstone and jewellery industry. It is so indispensable that everything eventually stops without it. Thus, a working knowledge of the journey rough takes from mine to market – as well as its evolution and its outlook for the future – can assist jewellers in their planning process.

Rough is the lifeblood of the gemstone and jewellery industry. It is so indispensable that everything eventually stops without it. Thus, a working knowledge of the journey rough takes from mine to market – as well as its evolution and its outlook for the future – can assist jewellers in their planning process.

Firstly, it is essential to understand that much of the rough gemstone trade exists in the shadows. The nature of dealings, and even mining itself, are highly secretive, with many detours and pathways that can almost never be entirely illuminated. And as markets are created or cease to exist, that path to the end consumer is always changing.

The journey of rough begins at the mines. Even though mines are located throughout the world, most are left unworked. To make mining possible, the right set of variables has to come together in perfect balance.

The key is economic feasibility; once mining is deemed economically feasible, it leads down the path of either artisanal and small-scale mining (ASM) or large-scale mining (LSM).

ASM refers to mining activities carried out by independent subsistence miners or small-scale miners who are mainly local, with short-term outlooks. Most of these miners work informally, outside of a legal framework, in remote areas, and depend on manual labour with basic tools.

LSM refers to more formal mining on a larger industrial scale, within a legal framework and operating with greater transparency. This often involves heavy equipment, large capital expenditure, and usually a foreign component or entity managing the enterprise.

These definitions are general in nature, and sometimes country- or mine-specific, with the demarcation between the two not always black and white.

The nature of mining

Economic feasibility is responsible for the ASM nature of most gemstone mining.

According to a report published by the International Institute for Sustainable Development1, an “estimated 40.5 million people were directly engaged in ASM in 2017, up from 30 million in 2014, 13 million in 1999 and 6 million in 1993. That compares with only 7 million people working in industrial mining in 2013.”

When looking specifically at gemstone mining, the numbers point to even greater ASM hegemony. African Mining Vision, working under the UN Economic Commission for Africa, found in 20092 that almost all African gemstones, other than diamonds, are produced by ASM.

In the intervening years, LSM has made more significant inroads into the gemstone sector – however, it is still overwhelmingly ASM in much of the world.

A great deal of investment in time and resources is needed before realising any profit in LSM – in contrast to ASM, which allows for great flexibility without much investment or planning. This has historically allowed ASM to flourish where local artisanal miners do not have to undergo the scrutiny and regulatory oversight of more formal LSM.

Artisanal miners can, at times, mine out small gemstone deposits informally within the time it would take for larger competitors to acquire licensing alone.

To be lucrative for LSM, a deposit must possess significant long-term reserves. Many, if not most gemstone deposits, lack the scale of reserves needed.

However, the size of some gemstone reserves has helped large investment groups like Canada’s Fura Gems and the UK’s Gemfields to enter the sector. These companies possess significant financial resources from public listings on major international stock exchanges.

They have also developed business models offering their rough production at auction directly to select ‘sightholders’, emulating the De Beers Group’s strategy with diamond sales.

It is interesting to note that what works in some countries or circumstances may not work in others. For example, in many developing countries, artisanal miners thrive because of lax laws, limited resources for enforcement, and corruption.

Artisanal mining has a much more difficult time in developed countries with stricter laws or regulations, greater enforcement, and limited corruption, all of which favour LSM.

Another significant force in favour of ASM in gemstone deposits is the difficulty in developing grading standards that are both economical and universally accepted.

This is very different from mining for industrial minerals, with internationally established standards based on purity and raw weight. Additionally, if there are purity concerns with such minerals, they can be alleviated via purification processes.

This is impossible with gemstones, where impurities are intrinsic and inseparable – be they detrimental or beneficial.

Grading gemstones is also far more costly and laborious a process, as one goes from one to another manually in a far less objective manner than most industrial minerals.

Indeed, grading gemstones is almost an art that can defy logic, where rough prices may occasionally outpace what their finished products command.

Diamond is the only gemstone that has managed to come close to a universally-accepted standard. This partially accounts for why only about 20 per cent of diamond production is attributed to ASM, in contrast to 80 per cent of sapphire production, which is much more subjectively graded.

Marketing, rising values, and gemstone deposits with large reserves have helped the development of international standardisation over the past few decades.

Notably, Gemfields – which mines emerald and ruby – has incorporated state-of-the-art technology to develop such standards in its mining projects.

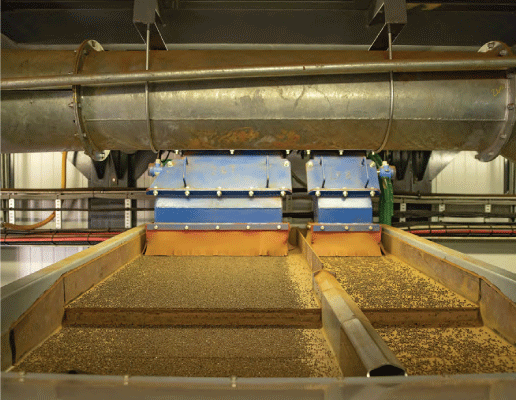

For example, the company recently invested $US15 million setting up an industrial-scale sorting facility at the Montepuez ruby mine in Mozambique.

The facility incorporates diamond industry technology to extract, grade and sort rubies with enhanced consistency, ensuring a regular supply to sightholders.

Such accomplishments and efforts have increased the appeal of gemstone LSM in the eyes of many governments.

Governments and culture

Many governments have traditionally favoured LSM activities over ASM because of more substantial capital investment, greater oversight, and higher potential for tax collection.

This has led to a resurgence in attempts at greater government control over gemstone mining and exports.

Ethiopia, Kenya, Rwanda, and Tanzania, for example, have all moved towards establishing government-based values of gemstones to stop exports at deflated values, and help generate more tax revenue.

These efforts are not always perfect, and some are better implemented than others. Often, regulations have indeed improved tax revenues, but also led to increased smuggling and mine closures.

The right amount of government involvement is always a balancing act, with an elusive goal of perfection.

Regardless of the scale of mining, gemstone rough begins its journey toward the end market almost immediately after extraction. The path it takes and the speed vary depending on many factors; there is no uniformity in the paths, even though they may occasionally overlap.

Rough from African ASM production is generally sold immediately or shortly after extraction. This is primarily due to miner independence (though this is not always the case and is dependent on agreements, or even cultural norms, around a locality).

In comparison, south and southeast Asian miners do not work as independently, though gemstone mining in Asia is still almost exclusively ASM.

Most ASM in Afghanistan, Pakistan, and Vietnam, for example, is composed of small groups working as cooperatives, usually funded by an outside investor that has some kind of claim over any production.

The investor usually commands the loyalty of the cooperative members based on tribal or familial ties.

Once the miners extract material, it is usually held ‘in trust’ with the first buying rights given to any investor. These deals can take place in the mining areas, intermediate markets in neighbouring towns, or regional markets in larger cities.

This has ensured higher prices and greater stability for Asian goods – contrasting sharply with those goods produced by more independent African gemstone miners.

There are other differences between the African and Asian ASM paths too. For example, Asian production tends to move greater distances along the path to the end market between trades.

This is particularly true of Afghanistan and Pakistan, where gemstone deposits are almost exclusively primary – that is, the gemstones are found where they formed, and must be extracted from tonnes of non-gemstone-bearing material.

Indeed, the nature of primary deposits necessitates a cooperative work ethic; it is highly unlikely one would witness a primary deposit run independently by a single individual, whereas this can be very common in alluvial mining.

As would be expected, the lack of alluvial deposits in Afghanistan and Pakistan has been a significant factor in the creation of a group ethic. Primary deposits in Africa have helped nurture the same.

Pathway to market

Production from primary deposits tends to be in ‘pockets’ with relatively uniform colour and quality.

When a pocket is unearthed, it generally always finds its way to the initial investor’s hands. The larger-scale production helps to cut out smaller middlemen with limited financial means.

Alluvial deposits, by contrast, produce stone-by- stone – or in smaller quantities with considerable variation in colour and quality. Increased effort and time are required in collecting and sorting these stones.

This creates greater competition along the path to regional markets as smaller dealers with limited financial resources compete in acquiring single stones or smaller parcels of alluvial findings.

That structure is common in Tanzania, for example. There, networks of intermediaries and miners

are established, creating a path to collect gemstones into larger parcels as they change hands repeatedly, moving along supply chains towards regional markets.

In Asia, pockets of rough tend to move more rapidly to the markets – where the investors are usually based – and seldom change hands.

Most rough supply paths begin merging in regional markets. Master dealers in African regional markets facilitate the collection of rough from a network of miners and intermediary sources.

These dealers form the heads of regional supply networks, specialising either in a single gemstone or a variety of gemstones. Technology and the ease of modern travel have helped transform many of these once-stationary pillars of regional markets into versatile players that can function as local or international finished gemstone suppliers, rough sellers, mining investors, and transporters.

Depending on the depth of their pockets, they may even be able to merge production from ASM and LSM. Asia has master-dealer counterparts in their regional markets.

If rough survives the regional market without finding its way to the cutting wheel, it is sold as rough locally until it finds a buyer or transporter to export it to major international markets.

The markets in China, Germany, Thailand, and the USA are where the material will ultimately be processed. These are the main markets where rough traders bring their acquisitions for resale.

Culture, local trends, market demand, and structural realities set them apart.

Increasing competition

|

| Above: Wallace Chan ‘Whimsical Blue’ brooch by Wallace Chan, with jadeite, tanzanite, diamond, lapis lazuli and sapphire. |

Globalisation, technological evolution, and ease of travel have not only helped master dealers and other network members in adopting versatile roles, but they have also opened up the exclusive fields to greater competition, from mine to market.

In Mozambique and Nigeria, West Africans from Guinea, Mali, and Senegal helped find and develop rough supply networks over decades through immigration and assimilation. They have managed to extend their networks deep into China, Hong Kong, and Thailand.

As West Africans moved outward and embedded in rough supply chains around the world, foreigners moved in, taking up various roles in the local and regional supply networks of Africa.

It is common to now see Sri Lankan and Thai people embedded in sapphire and ruby supply chains all the way to the mines in Madagascar, Mozambique, Nigeria, and Tanzania. Indian people have taken similar roles with different gemstones in the latter.

Afghanistan and Pakistan, by contrast, have been plagued with civil strife and insecurity in recent decades. This, along with cultural and familial norms, has functioned to prevent the same supply chain integration seen in much of Africa, ensuring the gemstone trade stayed firmly in the hands of locals.

The limited integration, coupled with instability, have helped to push regional master-dealers into new roles and it is now common to see Afghani and Pakistani people integrated along supply paths to international markets.

Increased demand from eastern Asia has accelerated this integration, and they now control a rapidly growing international market share of the gemstone industry with offices and storefronts in mainland China, Hong Kong, and Thailand.

This rapid growth has pushed some to travel into parts of Africa to continue to feed their markets with rough.

While regional markets in major cities of Africa generally allow for trading with a high degree of security, there are elevated risks associated with the secretive and cash-based nature of the industry.

Cash, in particular, tends to bring out the predators, and foreign currency limitations can severely compound the problem. Transactions done outside of regional markets are almost exclusively in local currency. Depending on the location and exchange rates, this may mean carrying highly visible, bulky local currency instead of US dollars.

Proper networking and planning should be done before departing outside of regional markets with local guides, who have been thoroughly vetted.

Many buyers have sought to trace their way back to mines in search of the legendary deals associated with buying at the source – yet the reality is quite different. If travelling buyers are not disciplined, well informed, and networked, they can find their safety compromised and quite often incur heavy losses; most miners and traders along the rough supply chain are well-versed in current market prices.

Indeed, new finds with rapidly-developing ‘rushes’ – when a buyer can encounter phenomenal deals – are the exception, not the rule. This occurs when a discovery or production of

rough is freshly extracted, and there is limited gemstone knowledge, or a lack of liquidity, in the local market.

Such occurrences are rare, short-lived, and generally require rapid travel to remote areas before regional and international market exposure allows prices to stabilise.

For buyers to take advantage of opportunities that international gem trading provides, traders must have extensive knowledge of their ultimate markets. In the world of gems, “You make your money when you buy, not when you sell.”

Impacts and conclusions

The global integration and evolution of the gem industry has altered the landscape and inverted the established paradigms; there has been a shift in the buying pattern and mindset of consumers.

|

| Above: Suzanne Syz Art Jewels ‘Chester eld’ ring by Suzanne Syz, with rubellite and brown diamond. |

Their desire for greater accountability and authenticity has echoed up the supply chain, calling for greater accountability, Fair Trade, sustainability, and transparency.

The marketing of these desires is a legacy adopted from the diamond trade.

The benefit of these practices has been instrumental in the successful promotion of jewellery designers, lapidary artists, and even powerful mining companies accounting for a larger percentage of production, such as Gemfields.

Meanwhile, the desire for greater transparency has led to calls for incorporating blockchain technology into the supply chain, and even the advent of the ‘Emerald Paternity Test’, which allows invisible ‘tagging’ of emeralds, at the source, with nanoparticles for future origin identification.

There are several companies undertaking such efforts. However, their success remains to be seen in an industry governed by considerable secrecy.

In the US, jewellery designers adopting and promoting these desires for accountability, sustainability, and transparency has helped facilitate the growth of independent lapidary artists.

Consumers are willing to pay higher prices to support local manufacturing, moving away from both mass-production overseas and local corporate dominance.

Greater awareness and demand for the services of lapidary artists, aided by cultural changes, have reversed their decreasing numbers over the last few decades.

Many of these artists have developed massive followings of direct support for their domestic cutting thanks to the emergence of digital technologies and platforms, while jewellery designers’ efforts to provide the ultimate customer experience have facilitated the creation of vertical alliances with lapidary artists for complete in- house services.

Some designers have even mastered the skills necessary in all phases of jewellery creation, from drafting, to cutting or carving of gemstones, to fabrication.

At the same time, the market demand has increased for larger quality rough gemstones, which are more economical to process.

This demand has resulted in higher prices and greater international competition to select rough.

Traders accustomed to production sales have altered their buying and selling practices to account for these developments and have modified their supply networks accordingly.

They are selling smaller parcels and select stones aided by the emergence of digital technologies and platforms.

Traditionally, miners and rough gemstone traders in source countries preferred to sell production primarily to commercial Asian cutting houses.

However, greater competition and higher margins have motivated miners and regional master- dealers – who traditionally neglected the more selective buyers – to accommodate them.

These developments have allowed consumers, designers, and lapidary artists increased access to rough without the need to travel.

Meanwhile, the sense of accountability, with greater transparency of the supply chain, has provided a more intimate relationship with rough suppliers to develop.

| Left: Gemfields’ UV optical sorter with concentrate split between coarse and medium sections. (Image credit: Gemfields) |

| Left: Aerial view of the rough sorting house at Gemfields’ Montepuez ruby mine in Cabo Delgado, Mozambique. (Image credit: Gemfields) |

This article was originally published in InColor’s Spring / Summer 2020 issue and has been edited for Jeweller. Please click here to read the full article.

Footnotes

1. Fritz, Morgane et al. (2017) “Global Trends in Artisanal and Small-Scale Mining (ASM): A Review of Key Numbers and Issues.” International Institute for Sustainable Development

2. African Union (2009) “Transparent, Equitable and Optimal Exploitation of Mineral Resources to Underpin Broad-based Sustainable Growth and Socio-economic Development”, Africa Mining Vision

How do you become #1?

Read eMag

Hover over eMag and click cloud to download eMag PDF