We have followed the ups and downs of Australia’s COVID-19 politics as we watched the rest of the world twist and turn under the insidious influences of the Delta strain during the pandemic. It seems that hospitality and entertainment have been the big losers as they rely on customers coming in and sitting down for lunch or dinner or attending live events and trade exhibitions.

We have followed the ups and downs of Australia’s COVID-19 politics as we watched the rest of the world twist and turn under the insidious influences of the Delta strain during the pandemic. It seems that hospitality and entertainment have been the big losers as they rely on customers coming in and sitting down for lunch or dinner or attending live events and trade exhibitions.

As we know, it is this very form of business that logically suffers from lockdowns, which prevent in-person attendance and reduce retail ‘foot-traffic’.

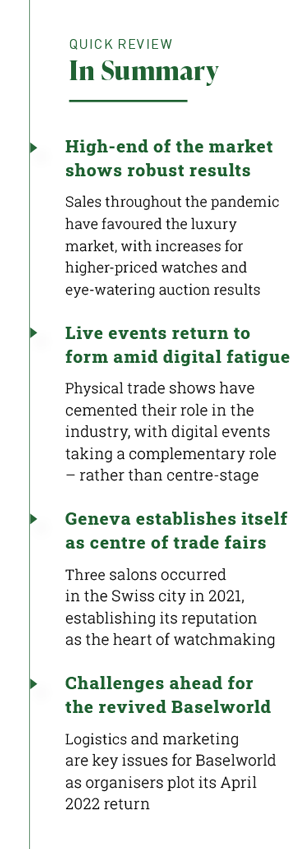

In contrast, the extraordinary performance of the watch industry shows another side to the lockdown coin.

Sales figures indicate that consumers at the top of the market were largely unaffected by the rules and restrictions – they simply had to find a different way to dispense their buying power.

There are many examples to illustrate this point.

Industry media has reported Rolex and Tudor sales in the UK and Ireland generated sales of £468 million ($AU867.7 million), up from £415 million ($AU769.4 million), an increase of 13 per cent even during the lockdown chaos.

As an example of unbridled insanity and excess funds was the auction of a newly-released Patek Philippe model – a factory-sealed olive-green Nautilus – which was sold in April by Antiquorum in Monaco.

The nominated retail price of $AU48,000 was utterly dwarfed by the auction sale, which was a staggering $AU650,000 including buyer’s premium. Bidders online and in the saleroom refused to back down until the price nudged half a million US dollars.

That was just one example! Research, conducted by retail analytics firm GfK, also reveals other distortions in the watch market.

Total watch sales value in the UK in August for models priced at £500–1,000 ($AU925 –1,851) fell by 7 per cent – but increased by 31 per cent for models priced at £5,000–10,000 ($AU9,257–18,515), and saw a stunning rise of 19 per cent for timepieces priced at more than £10,000 ($AU18,515).

Overall, average prices rose by more than 61 per cent for the 12-month period from September 2020 to August 2021 as customers actively sought more expensive watches.

GfK’s research reported that for July 2021 alone, the total value of watch sales in Great Britain was 34 per cent higher than in the same month in 2019.

Swatch Group – which includes brands such as Omega, Tissot, Breguet, and Longines, among others – went against the trend with a 39 per cent revenue decline in 2020.

However, this was of its own doing and partly a result of the unsettled restructuring of its UK operations.

The Swatch result is an exception, and we may safely observe that there is unrestrained wealth at the top of the market burning holes in the pockets of buyers who suffer no budgetary cares – and the watch industry is happily celebrating the bonus.

Return of the fairs

In the meantime, the physical fairs are starting to re-emerge as the online promotional meetings of the last year achieved an unenviable result – the highest-ever boredom ratings!

Contrary to some industry declarations, digital-only presentations are not “the way ahead” at all, and the sooner that physical fairs re-establish their presence, the better the quality of the review material for the press, agents and buyers alike.

Rob Corder, co-founder and editor of the UK industry publication WatchPro, has been a staunch advocate for events where watch lovers can indulge their passion in the company of the world’s most exceptional watchmakers.

He wrote earlier this year, “Zoom and webinars are a necessary but appalling substitute for live events like Baselworld, Watches & Wonders, and boutique shows in the most important markets like the UK, US, and Germany.”

In support of his own stated views, WatchPro has scheduled its own Salon event from 12–13 November at the five-star Londoner Hotel on Leicester Square.

Japan’s Grand Seiko and more than 20 small-yet-established quality brands in attendance.

Meanwhile, the Hong Kong Watch and Clock Fair (HKW&CF) – a joint exposition of the Watch & Clock Fair and Salon de TE, by far the largest of the fairs in normal times – opened on 12 September.

The five-day physical event attracted approximately 4,900 industry buyers and more than 23,600 public visitors to shop

for timepieces.

The last COVID-free year for which foot traffic information is available was 2018, when attendance totalled 21,000 buyers for 830 exhibitors from 25 countries and regions.

The fair’s organiser, the Hong Kong Trade Development Council, has good reason to be pleased with this slightly increased attendance in this difficult year.

Boosting this attendance was the decision to, for the first time, open the HKW&CF to the public for the full period of the fair.

An online version of the HKW&CF was also launched for the first time this year and ran until 19 September.

|

| Above: Christophe Claret |

Benjamin Chau, deputy executive director of the HKTDC, said, “The Watch & Clock Fair and Salon de TE returned as special editions this year to help generate business opportunities for industry players.

“Opening the five-day fairs to the public for the first time also provided an excellent opportunity for watch and clock traders to reach out to retail customers and boost the industry’s retail businesses.”

He added, “According to our on-site survey, public visitors who were interviewed spent an average of $HK1,059 [$AU183] per person at the fairs.”

Precision watchmaking equipment show, EPHJ in Geneva, returned with its first live exhibition since 2019 as the pandemic receded in Europe and brands and buyers returned to in-person events.

More than 12,000 people attended EPHJ during the four days of the show, where 530 exhibitors were showcased from 13 countries, representing watchmaking and microtechnology.

This figure was, understandably, down from 20,000 attendees and 800 exhibitors in 2019.

Jeweller previously reported the successful Watches & Wonders (W&W) Geneva online edition in April 2021 – its second online-only event in as many years – as well as its physical W&W Shanghai show, held immediately afterwards.

W&W Geneva is now confirmed to take place in 2022 in both physical and digital formats, via the watchandwonders.com platform and at the Palexpo exhibition centre from 30 March–5 April.

And speaking of Swiss fairs, one cannot ignore Geneva Watch Days.

Following the COVID-19 pandemic and the collapse of Baselworld, Geneva Watch Days was founded in 2020 as an independent fair, spearheaded by the like-minded Bulgari, H. Moser & Cie., Breitling, Ulysse Nardin, Urwerk, Gerald Genta, MB&F and Girard-Perregaux.

This year it was presented from 30 August–3 September in a 'phygital' format – a mix of in-person and virtual presentations – to address the visitor restrictions created by the global pandemic.

This was five days filled with innovations, new designs, concepts, limited editions, affordable – and untouchably expensive – watches released by some of the world’s renowned manufacturers.

Baselworld - a brand seeking redemption

Only a few years ago, Baselworld was the leading go-to fair, but it spectacularly fell from grace for reasons widely canvassed in Jeweller and elsewhere.

Baselworld is now doing everything it can to recover its credibility with watch brands and is adopting a ‘gently, gently’ approach to achieve this. But it will be hard work for a couple of very pertinent reasons.

Firstly, Rolex, Patek Philippe, Tudor, Chanel, and Chopard were fiercely loyal to Baselworld but left as a bloc in April 2020, with just a hint in the air that MCH Group – the Baselworld organiser – had been careless with its reciprocal loyalty.

Undoing this damage is not, and cannot, be an easy task as the issues accumulated over some years.

But Baselworld can only really feel at ease if, or when, the industry pillars of Patek Philippe and Rolex return to the Messe Basel exhibition centre.

Three years on from the ‘watershed’ year of 2018, when natural diamond juggernaut De Beers introduced Lightbox Jewelry, the lab-created diamond category has gone from strength to strength.

In the meantime, the next problem facing Baselworld is that the centre of horological gravity has shifted from Basel to Geneva; Baselworld’s defecting ‘big names’ established their new salon in Geneva, in conjunction with the ‘opposition’ Watches & Wonders.

Therefore, Baselworld has a logistical problem in that Basel and Geneva are at opposite ends of Switzerland. Expecting good coverage of Baselworld exhibitors when buyers and media are all down in Geneva may be a forlorn hope.

To re-establish its presence, the ‘new’ Baselworld was launched with a big step outside its traditional premises to reconnect with the industry and the media.

It was presented via a new pop-up event in Geneva, which ran from August 30, simultaneously with the Geneva Watch Days.

This event was marketed as “presenting the new Baselworld spirit, with 10 independent brands and a program that favours openness, conviviality and networking.”

While on a far smaller scale to the traditional Baselworld event, it was the first step in the build-up to the return of the larger physical show, Baselworld 2022, which will take place from 31 March 31–4 April next year.

Meanwhile, the annual highly regarded Only Watch auction is the next event of the industry – and both the watches themselves and the charitable proceeds will make for an interesting saga to observe.

There is no shortage of promotional material in the horological ether, as brands try to compensate for the lack of fairs this year.

Manufacturers, buyers, agents, and the media are all looking forward to a 2022 resumption of the affairs of the industry, unhindered by virus-driven politics.

In the meantime, the new releases and record-breakers of this year act as tempters, reminding us of the exquisite pieces we have all been missing – and deserve to see, in the flesh, once again.

read emag