Whether it is the Australian Bureau of Statistics (ABS) recording the number of annual marriages, through to wedding planning websites surveying their users about their experiences and the average cost of engagement rings, the wedding business is still vibrant and certain trends are highlighted as they become more prevalent depending on the economic climate.

Whether it is the Australian Bureau of Statistics (ABS) recording the number of annual marriages, through to wedding planning websites surveying their users about their experiences and the average cost of engagement rings, the wedding business is still vibrant and certain trends are highlighted as they become more prevalent depending on the economic climate.

And even better, when it comes to one of the most important aspects of marriage – selecting and buying an engagement ring – it seems that couples still prefer dealing with independent jewellers over online websites.

That is, despite the increasing popularity of online shopping and the growth of specialist diamond jewellery websites, various studies have found 67 per cent of people who decided to marry purchased their engagement ring instore, from a specialist jewellery retailer

In addition, the 2021 Jewelry and Engagement Study that was released in December– conducted by The Knot, a US-based digital wedding planning, and registry website – found that about 50 per cent of the sales took place at local jewellers after the proposer visited up to three jewellery stores before making a purchase.

Effectively, the survey indicated that engagement ring shoppers shunned a digital purchase, preferring face-to-face consultation, advice and design: “While online channels, such as social media and jewelry websites, continue to be the leading resource for ring research and inspiration, proposers value the importance of in-store shopping.”

Interestingly, The Knot’s 2020 survey of 5,000 newly engaged individuals in the US found that ring shopping experiences looked different during the first year of the pandemic.

Along with planning their proposal within a shorter time frame to account for constantly evolving pandemic conditions, the state of the economy and overall uncertainty around the future did not impact engagement ring 'spends' for 86 per cent of to-be-weds.

Confronted with COVID, shopping for engagement rings for the period continued to be a two-person activity for most couples, as 72 percent of proposees reported being involved in the selection of their engagement ring.

In fact, surprisingly, the 2020 report found that there was minimal change to the national average cost of an engagement ring in 2020 - $5,500, compared to $5,900 in 2019.

One year later, the same study found that the average spending on engagement rings for 2021 increased slightly to $US6,000 ($AU8,387). This increase may be attributed to a rise in diamond prices overall, but it hasn’t deterred couples from spending more in order to buy their perfect ring.

While the increase was not significant, given all the doom and gloom over the past two years it would not have been surprising if there were a decline in average price purchases.

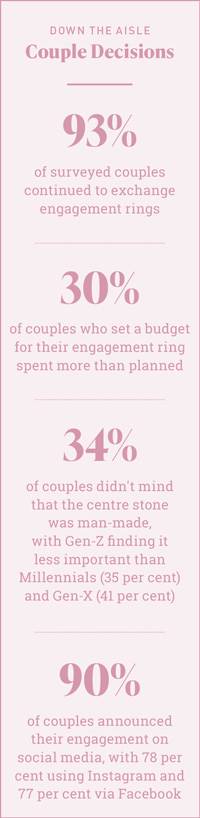

In more good news for specialist fine jewellery retailers, 93 per cent of respondents exchanged engagement rings of which 83 per cent were diamond-set with an average size of 1.5 carats, while one in four ring designs consisted of a centre stone weighing more than 2 carats.

Closer to home, a 2020 survey by Wedded Wonderland, an Australian-based wedding directory website reported that the average engagement ring spend rose to $12,690 from $11,753 in the previous year’s survey, representing an 8 per cent increase. The data came from a poll of 839 brides-to-be.

Further, another survey of retailers by Instore, a US business-to-business magazine for jewellery store owners (similar to Jeweller) found that 61 per cent of jewellers said that more than half their customers came back to the buy their wedding rings, while 18 per cent said around half revisited the store for wedding rings.

The initial engagement ring purchase acted as a catalyst for ongoing business years ahead.

Style and size

|

| Source: The Knot |

Another standout statistic was that The Knot survey found that the 48 per cent of rings were custom-makes, which goes hand-in-hand with the recent shift back to custommade jewellery throughout the industry.

Colin Pocklington, managing director of Australia’s largest jewellery buying group, Nationwide Jewellers, has regularly reported on the importance of this category and trend to members.

In the midst of the COVID pandemic, Pocklington attributed stronger sales to “increased consumer confidence now that the virus is largely suppressed, a large number of Australians who would normally be overseas are spending their money domestically, and continued strong growth in custom design and manufacture”.

He also says that the growth in consumer demand for custom designed jewellery will continue and provide substantial turnover for bricks-and-mortar stores as consumers search for something ‘different’.

“There is still a huge opportunity for further growth in custom sales, particularly as bricks-and-mortar store sales are more profitable than online sales. That’s because, on average, most products sold online are at a lower price point than those sold in-store as the vast majority of consumers buying online are searching for the lowest price available,” Pocklington explains.

Whenever there is an economic crisis, such as a pandemic or global recession, people reevaluate their lives and that’s certainly true over the past two years.

“I think after going through something as trying as a global pandemic, people tend to put a renewed importance on things that are everlasting” says Alex Stuller senior bridal director Stuller adding, “The ultimate commitment is represented in engagement and wedding bands, and couples are looking to customise them even more to make them special.”

The customised trend would not surprise Reza Bapooji business development manager Pallion, who says, “Couples are desiring a ring that uniquely represents their partnership. It is definitely a more collaborative project, and a design will often evolve to cater to individual preferences.”

Brendan Cunningham agrees. The managing director of Salt & Pepper Diamonds says, “People want that unique piece with a unique stone, they want modern with a twist and, most importantly, affordability.”

Larger diamonds are still the main focus according to Maulin Shah director World Shiner, one of Australia’s leading diamond dealers. “We find that customers still prefer the ‘big one’, the larger diamond trend is still on-trend. There’s a shift towards different shapes and to colour diamonds, but the majority [of sales] is still the white diamond.

“Diamond prices have increased as well, which means the size demand has remained much the same.”

Jay Ivany, chief executive officer ADTC, another leading diamond supplier has also noticed a shift to larger diamonds since 2019.

“We have a lot more people buying bigger stones, the trend of travel budgets being directed towards other forms of happiness in diamonds and jewellery has continued over the past 12 months,” Ivany explains.

Of course, there’s been a huge shift in consumer demand to eco-friendly products and services and it has filtered through to the jewellery industry.

The Knot reported that sustainability awareness has also become an emerging trend, where nearly one in four engagement rings were lab-created stones, which indicated an increase by 11 per cent on the two-year difference when compared to a 2019 survey.

Chris Soklich managing director Ellendale Diamonds agrees: “Couples are more aware of design and want meaningful details rather than an off the shelf look. Conscious ethical sourcing and sustainable materials are key for many couples.”

This accords with Miriam Neubauer, director Grown Diamonds who says, “With many people these days being eco-conscious, we have found that our clients' customers are leaning towards the more eco-friendly option of lab-grown diamonds”.

One of the stalwarts of the traditional wedding and engagement jewellery category, Peter W Beck, has also recognised the trend. Greville Ingham national sales manager says, “there’s more demand for lab-created diamonds”, reaffirming the same fact that “Due to COVID-19 customers are not spending money on holidays, travelling or honeymoons which has allowed for them to spend more money on engagement rings and wedding bands.”

In terms of other trends yellow gold engagement rings have become increasingly popular among study respondents while demand for white gold engagement rings has declined in recent years.

The shape of love

Shape and setting were considered important features with round cut diamonds as the most popular at 41 percent, while oval cut diamonds have also seen an increase by 2 per cent in 2015 to 19 per cent this year.

Closer to home, industry suppliers experienced slightly different demand depending on their own market niche.

“Obviously ovals and pear shapes are super popular and have been for the past few years. We have also seen a surge in requests as well for elongated cushions and radiants,” Ivany says.

Pallion has had similar results: “Oval, pear, always round and most recently emerald cuts are making a resurgence in popularity” are popular according to Bapooji and for Neubauer, “The 1 and 2-carat sizes have been extremely popular while rounds are consistently popular followed by ovals and pear shapes.”

Likewise, Ingham advises that “Oval and emerald cut stones are popular followed by larger marquise although round brilliant cut is still the largest category, Also yellow sapphire emerged in queries this year’, while Stuller says that “Round remains the reigning queen, but oval is coming in a hot second place.”

Colour – diamond or gemstone - continues to be something non-traditional couples are looking for.

“Unique pieces featuring colour diamonds/stones and unusual cuts with vintage themes are having a resurgence. Elongated styles with oval cut diamonds are also very popular,” Soklich explains.

“Round brilliant cut and exceptionally peppered looking diamonds have been most popular and fast to move. Pears are quite desired also however there tends to be some variance in the shape of these and kites and hex cut are also on top of the list,“ for Cunningham.

Shah says that across all of the World Shiner state offices “the number one [shape] is still round and the second most popular is oval. The third is pear-shaped, followed by cushion, emerald, princess cut, marquise and heart shape.”

So where to from here? Well, if the various surveys are accurate, then independent jewellery retailers still rule the roost when it comes to couples getting engaged for many reasons. This includes face-to-face assistance for one of the most important decisions of a couple’s life together.

From real-time advice on the centre stone shape, size and type to identifying the strengths and weaknesses in a couple’s custom-design, nothing beats the experience of working with a jeweller to ask all the right questions.

While the category had its ups and down throughout 2020/2021 with many weddings being postponed, and then postponed again, due to government restrictions, the vast majority of brides- and grooms-to-be rescheduled their ceremonies instead of cancelling.

This has led many people to predict that this year – and 2023 – could well be a boom year for engagements and weddings.

Indeed, Stuller’s senior bridal director has predicted that: “2022 is projected to be the biggest year for weddings since the early ‘80s.

“Jewellers should make sure they’re ready to walk couples through their special day. Clearly communicating your customisation capabilities will be more important than ever as couples continue to choose customisation over in-stock designs,” Alex Stuller advised.

|

Greville Ingham

Peter W Beck “Due to COVID-19 customers are not spending money on holidays, travelling or honeymoons which has allowed for them to spend more money on engagement rings and wedding bands.” | |

Alex Stuller

Stuller "Clearly communicating your customisation capabilities will be more important than ever as couples continue to choose customisation over in-stock designs." | |

Maulin Shah

World Shiner “We find that customers prefer the ‘big one’, the larger diamond trend is still on-trend. There’s a shift towards different shapes and to colour diamonds, but the majority [of sales] is still the white diamond." | |

Reza Bapooji

Palloys "Couples are desiring a ring that uniquely represents their partnership. It is definitely a more collaborative project, and a design will often evolve to cater to individual preferences." | |

Chris Soklich

Ellendale Diamonds "Couples are more aware of design and want meaningful details rather than an off-the-shelf look. Conscious ethical sourcing and sustainable materials are key for many couples.” |

|

Read eMag