INDUSTRY STATS

ANNUAL GROWTH

2020-2025

Traditional Watch

Increase

9.92 per cent

_________

Smartwatch

Increase

14.5 per cent _________

Hybrid Watch

Increase

14.5 per cent |

WATCH GUIDE INDEX - click item to Jump to RELEVANT section

• Time to split: the exhibitor exodus

• Taking a bite of the Apple

• Apple watch and the Swiss: a genuine rivalry?

» Download eMag: Watch Showcase - New and bestselling designs

The decline of Baselworld – once the world’s premier watch and jewellery fair – became clear between 2017 and 2018, when the exhibitor number nearly halved from 1,300 to around 650.

Shortly after the 2018 show, Swatch Group pulled out of exhibiting its 18 brands at future editions of Baselworld, followed by Raymond Weil, Corum and Maurice Lacroix.

This year’s event has been cancelled in the wake of the coronavirus pandemic, which some industry commentators welcomed as a reprieve from what would have been a notably anaemic show, even when compared with previous years.

Indeed, it has been heralded by some as a chance to reinvigorate and renew the show – and the watch industry.

Perhaps the most notable trend within watches over the past five years is polarisation – the movement of consumer spending to the extremes of the category.

Luxury watches have maintained consistent revenue – the Federation of Swiss Watch Industry (FH) reported that exports were valued at CHF21.7 billion ($AU37 billion) in 2019, topping a record set in 2015 – albeit based on smaller sales volumes.

This trend indicates consumers are embracing more expensive models, as well as turning to the secondary watch market for choice.

Meanwhile, mid-range watch brands – generally defined as those between $600 and $2,000 – have seen their market share reduced by competition from smartwatches, while fashion watches have been influenced by changing consumer habits and online competitors.

However, brands have adapted to counter these threats.

Ultimately, the challenge for retailers is to navigate the shifting sands of the watch industry hourglass, taking note of competitor trends while ensuring the product mix is relevant to consumers and marketed through the correct channels.

The past five years have not only brought functional and material changes to the watch category, but fundamental differences in the way brands communicate with both retailers and consumers.

The interconnectedness and immediacy of global communication has changed how watches, from luxury Swiss timepieces to affordable fashion watches, are marketed and distributed.

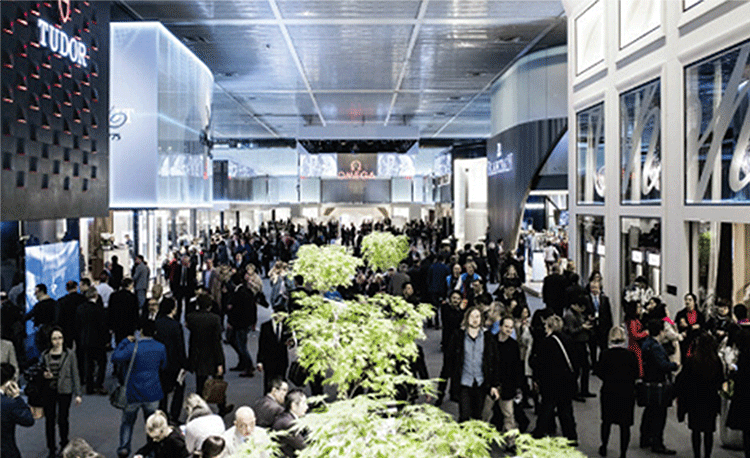

For decades, debuting new models amid the hustle and bustle of Baselworld’s Hall 1 was aspirational; a statement of luxury and success, lending prestige to a brand and its products.

It was also practical, ensuring marketing budgets could be focused on one major event, nearly all international retailers could be briefed on new products at the same time, and media representatives could report on a wide number of different brands without extensive travel.

But as the cost of exhibiting increased and global communications were simplified to more directly target consumers, Baselworld’s relevance receded.

View Jeweller's comprehensive Baselworld Timeline »

Suddenly, the crowds, noise and expense seemed less appealing, particularly when brands could host luxury retreatstyle product showcases for their retailers and distributors.

Some of these events even took place in Switzerland around the same time as Baselworld, including Swatch Group’s Zürich-based Time To Move conference and Movado Group’s Movado Summit in Davos.

At a time of unprecedented prosperity – 10 years after the Global Financial Crisis – the world’s most prestigious watch exhibition began to falter. Brands were no longer willing to pay Baselworld’s considerable exhibitor fees, reflecting the diminishing returns of the exhibition model itself.

It was not helped by the intransigent attitude of show organiser MCH Group. Michel Loris-Melikoff, managing director Baselworld, told Jeweller last year, “MCH organised Baselworld and if you wanted to be part of the show, you had to accept everything – take it or leave it.”

|

| Above: In its heyday: Baselworld was still drawing large crowds in 2016. |

Yet the problems were not solely attributable to MCH.

The Geneva-based Salon International de la Haute Horlogerie (SIHH) was not immune, losing Audemars Piguet and Richard Mille following the 2019 edition.

Loss of exhibitors was among the factors prompting the rebranding of the show to Watches & Wonders Geneva late last year. In 2020, it was set to include consumer-focused activities such as walking tours and a dedicated day of access to the show floor.

The two shows were also scheduled to run consecutively this year, shifting into a late April-early May timetable. However, the change in dates was the final nail in the coffin for many long-time exhibitors, including Seiko and Casio. Both brands withdrew from Baselworld in late 2019, given the dates would coincide with a week-long Japanese public holiday.

In January this year, LVMH – a long-term supporter of Baselworld – hosted its first ‘LVMH Watch Week’ at the company’s own Bulgari Hotel in Dubai. Bulgari consequently pulled out of the Swiss show, though TAG Heuer and Zenith were still scheduled to exhibit before Baselworld was cancelled in February.

However, some industry commentators have noted the ‘individual showcase’ strategy benefits brands at the expense of their retailers, distribution partners, and ultimately consumers.

Rob Corder, editor in chief of UK industry publication WatchPro , wrote earlier this year, “Rolex/Tudor, LVMH, Swatch Group, Richemont, Movado, Fossil, Breitling, Audemars Piguet, Grand Seiko, Kering and many others are refusing to come together into one, or even two, major trade shows, leaving retailers, consumers and press trawling the world for the first five months of the year.

“Every one of the groups and brands will tell you they will be putting on a fantastic show, but none appear to be listening to the needs of their key retail partners.”

He also dismissed the idea of Swiss exhibitions as consumer shows, stating, “Customer events should be in the countries of the customers and run by local teams, ideally in conjunction with retail partners so that people can actually buy the watches they see.”

Indeed, the coronavirus pandemic may make that a necessity through its devastating impacts on the travel sector.

The virus may also have another unintended result – reuniting the international watch industry.

It has forced not only the cancellation of both Baselworld and Watches & Wonders Geneva, but also a reassessment of priorities.

“Suddenly, the PR and politicking problems in the international watch market became insignificant as the ‘real people’ of the world went out to their supermarkets to fight over rice, pasta, hand sanitiser and toilet paper,” explains Martin Foster, watch industry journalist and Jeweller contributor.

He believes the Swiss industry should undertake a “health-check” and recognise that old rivalries should be forgotten in favour of more efficient, unified solutions.

“Baselworld has empty exhibition halls going begging with dedicated space available, if only the show formerly known as SIHH can grasp the enormous economic and political value of this opportunity,” he adds.

Looking ahead to 2021, Corder agrees that a “reboot” is necessary, focusing on a “luxurious and enjoyable to attend” show with retailers and members of the media hosted by the brands.

Crucially, exhibiting at the show should cost “a fraction of what Baselworld used to require”.

The pandemic has led to the cancellation or postponement of trade shows and events.

How are you adapting your communication with retailers?

Simon Garber

Heart & Grace "We are ensuring that our stockists know we are open for business and here to help. In tough times it is easy to forget there are still occasions for which people will be buying gifts, such as Mother’s Day. We also want to make sure that people know the key items needed to make sales and that we have those items in stock." _________

Phil Edwards

Duraflex Group Australia "The pandemic forces us to amend our approach. We will need to be strategic but also fluid, and support retailers and our brands as best we can." _________

John Rose

West End Collection "We are supporting retailers with online tools that allow them to be as successful online as they are in their physical store. We are seeing consumers become more inclined to purchase from the website of a brick-and-mortar store that they know and love, rather than a faceless marketplace. Consumers now trust the internet and in many cases prefer to purchase online, rather than in-store due to the convenience of doing so – not because it is cheaper." |

Time will tell if Loris-Melikoff can succeed in righting the ship and restoring the venerable show – and the watch industry, to its former glory.

It is difficult to overstate the impact of technology on the design and function of watches, most notably the introduction of the Apple Watch in 2015.

It marked something of a tipping point in the smartwatch category, prompting a monumental increase in consumer demand.

In 2014, US-based research firm International Data Corp (IDC) estimated global smartwatch sales at 4.2 million, which increased by more than 400 per cent the following year, to 19.4 million.

Apple Watches accounted for 11.6 million of those sales, according to IDC’s analysis. Today, Apple claims to have overtaken Rolex as the world’s ‘most valuable’ watch brand in revenue terms.

Despite a mixed-to-dismissive response from many in the traditional watch industry, the Apple Watch proved enduringly popular, with the number of units shipped increasing each year since its debut, according to reports by market research firm Strategy Analytics.

Apple does not publicly declare separate shipment or revenue data for the Apple Watch.

The devices retail for $US199–$US499 for a standard model, and up to $US2,159 for special editions made in ceramic or titanium – placing them in direct competition with fashion and mid-range luxury watches.

“Certainly, the introduction of smartwatches has had the most significant impact on the watch industry in the past five years,” says Phil Edwards, managing director Duraflex Group Australia, which distributes Swiss watch brands Baume & Mercier, Luminox and Mondaine, among others.

Alongside smartwatch models from the likes of Samsung, Garmin and Huawei, the Apple Watch has prompted extensive changes in the fashion watch category in particular, through increased competition.

Fossil Group – which includes fashion watch brands Fossil, Relic, and Skagen Denmark, and produes licensed watches under the Puma, Emporio Armani, and Michael Kors brands, among others – saw its net profits drop a precipitous 79 per cent between 2014 and 2016.

Reflecting on the results, Fossil CEO Kosta Kartsotis said, “Prior to that, we were clearly positioned as the competitively advantaged leader in a growing category. However, with the introduction of technology into wrist devices, traditional watches came under pressure and we were disadvantaged.

“We didn’t have the technology capabilities to compete with smartwatches, leading to a decline in our market.”

Meanwhile, Swatch Group CEO Nicolas Hayek Jr initially called the Apple Watch “an interesting toy, but not a revolution”. Swatch Group’s annual revenue fell 21 per cent and then 47 per cent consecutively in 2015 and 2016.

The company has since announced various forays into the smartwatch category – even developing the Swiss OS operating system – though none have materialised to date.

The extent of the threat from smartwatches was easy to underestimate. Notably, Microsoft’s smartwatch project, Smart Personal Object Technology, failed in 2005, leading to a lawsuit from Swatch Group after it was left with 100,000 unusable smartwatches.

Eight years later, Pebble – a pioneer in the smartwatch space – collapsed and was purchased by fitness tracker manufacturer FitBit. It seemed to confirm industry suspicions that smartwatches were struggling to differentiate from health and medicine-oriented ‘wearables’.

By 2017, the market was valued at $US9.2 billion ($AU14.9 billion); by 2025, analysts at Allied Market Research predict that figure will increase to $US50.3 billion. As a result, fashion watch brands have adapted to both differentiate themselves from smartwatches, and – through hybrid technology – mimic them.

John Rose, managing director West End Collection, which distributes Paul Hewitt, Christian Paul, Bering and ICE-Watch among others, tells Jeweller that the challenge is in attracting Millennials and Gen Z.

“As we see new generations come through, many of our younger target market are not growing up wearing a watch as we did. As a result, the watch industry has to be more creative, because people don’t ‘need’ to wear a watch to tell the time,” he explains.

|

| Above: Apple Watches, 2015-2020 |

Younger consumers see watches as a fashion item and an expression of their personality. “This means that watches have to make a fashion statement, perform a function or a make statement of status, for example,” Rose says.

In order to target these younger consumers, some brands have focused on increasing brand value through marketing techniques, such as influencer and celebrity endorsements, or adjusted prices to be more competitive.

Simon Garber is managing director at Heart & Grace, which distributes Cluse and Pierre Lannier. He tells Jeweller , “There has been a shift in the market as consumers have more options than ever before, however, we find that people love that Cluse has a RRP entry price point of $149.”

Additionally, Cluse – founded in Amsterdam in 2013 – has found success through digital marketing with European influencers, with designs that appeal to trend-conscious younger consumers.

Meanwhile, Luminox, distributed by DGA, recently announced a new collection designed with international adventurer Bear Grylls. In Australia, a limited-edition model designed with Bondi Beach lifesavers was released earlier this year.

The purpose of this marketing strategy is to communicate that Luminox is a technical, practical and hard-wearing timepiece, clearly differentiating it from the slick, urban image of many smartwatch brands.

In the mid-range luxury category, other brands, such as Australia’s Bausele, have extended their product line to include hybrids – that is, watches that combine the appearance of a traditional mechanical watch with the digital functions of a smartwatch.

Citizen is also expanding further into hybrids with its Connected and Eco-Drive models. Meanwhile, Fossil acquired smartwatch manufacturer Misfit in December 2015 and developed its own operating system, WearOS. By 2018, it had released more than 350 different ‘wearable’ models – both smartwatches and hybrids – across its eight brands.

The hybrid strategy may well pay dividends; Juniper Research has predicted hybrid watch shipments will increase by 460 per cent between 2018 and 2022.

However, while smartwatches have evidently sparked change in the fashion and mid-range categories, it appears the evolution goes both ways.

THE BASEL ROLLERCOSTER

1991

Cartier, Baume & Mercier, Gérald Genta, Daniel Roth and Piaget leave Basel to form their own Geneva show

_____________________ 2007 Baselworld welcomes 100,000 attendees for the first time

____________________ 2011 More than 2,000 exhibitors are present at Baselworld

____________________ 2013 Hall 1 is opened, reducing floor space for exhibitors

____________________ 2018 Exhibitor numbers fall to less than 700; Swatch Group discontinues involvement

____________________ 2020 Show moved to April, then cancelled due to pandemic

____________________ 2021 Show moved to January – will it succeed? View complete timeline » |

Increasingly, smartwatches are designed to imitate traditional dive watches and other tactical models.

An example is Garmin’s Marq Collection, which bears some resemblance to Citizen’s Land, Sea and Air ranges; its Captain, Aviator and Adventurer models include features such as ‘regatta timers’ and rotating bezels.

Meanwhile, some industry commentators have identified the trend of ‘functionality fatigue’ in consumers, who prefer simpler products that are more ‘watch’ than ‘smart’.

Jay McGregor, senior consumer technology contributor Forbes , wrote in February, “Years of testing overly functional wearables has taught me two things: they don’t perform tasks as well as your phone and they are, more often than not, just a distraction.

“If a company slaps a $300 price tag on device, it [had] better do a lot of things. But how about, instead, it doesn’t?”

Besides price, traditional fashion watches also have an aesthetic advantage over smartwatches. The appearance of a smartwatch largely depends on its hardware; more functions require a heftier case or a larger display.

Meanwhile, watch movements have enjoyed centuries of development into ever-slimmer cases. The functionality of a smartwatch is also dependent on software, which can frustrate consumers and limit choice; for example, an Apple Watch cannot be paired with an Android phone.

Additionally, extra charges may be required to use mobile functions, such as text messages and social media notifications.

Perhaps most significantly, smartwatches quickly become obsolete. In Fossil’s most recent quarterly report, CEO Kartsotis said, “We are disappointed to close the year with a challenging fourth quarter, which primarily reflects lower than expected performance in our older generation connected products.”

Meanwhile, traditional watches can be repaired and serviced, lasting for decades and maintaining their timeless features.

However, even when customers choose a smartwatch over a hybrid or fashion model, retailers can benefit.

In 2014, Jean-Claude Biver, CEO of TAG Heuer and president of Moët-Hennessy Louis Vuitton SE (LVMH) Watchmaking Division, said, “The Apple Watch is certainly a promotion tool... Apple is preparing this generation to make it easier, one day, to wear a real watch.”

Additionally, jewellers have begun to create custom metal smartwatch straps that mimic jewellery, while Swarovski manufactures a crystal-embellished Apple Watch case.–

Whether they are classified as a real watch, fancy toy, or disposable and expensive distraction, smartwatches are yet to conquer the traditional category entirely.

And it is the responsibility of retailers to ensure consumers are aware of the benefits of different products, and walk out of the store – or check out of the e-shop – with a timepiece that they love.

| There is more nuance to the impact of Apple on the watch industry than increased competition – and indeed, debate persists over whether smartwatches even belong in the same category as traditional watches. Martin Foster, watch industry journalist and Jeweller contributor, asks, “Is the Apple Watch’s ability to tell the time simply a side-benefit so it can be called a ‘watch’? Is it a watch or just ‘wearable technology’ that coincidentally looks like a watch and tells the time like a watch?” The answer is complex. | "The comparisons between a smartwatch and a Swiss mechanical could be likened to the debate of natural mined stones versus lab-created diamonds." |

The comparisons between a smartwatch and a Swiss mechanical could be likened to the debate of natural mined stones versus lab-created diamonds. While both types of devices are manufactured, one has a storied heritage and traditional prestige with a luxury price-tag and lasting value, while the other is a technical marvel with cutting edge and modern appeal, and a significantly lower price. In 2014, Jean-Claude Biver, CEO of TAG Heuer and president of Moët-Hennessy Louis Vuitton SE (LVMH) Watchmaking Division, said, “An Apple Watch – as great it can be – will always be the result of technological and industrial production processes. As such, in my opinion, it condemned to become obsolete. Therefore, after a few years, or less, its value will drop close to zero… For the time being, however, there is no comparison with the designs of Swiss watchmakers. There is no interest in the Swiss high-end and prestige-brand companies to create, produce, and sell watches whose values will likely vastly decrease over a short period of time, and which one day will not be repairable.” His comments proved prescient; Apple quietly withdrew its luxury 18-carat gold Apple Watch – which reportedly cost $US10,000¬–$17,000 – in 2016, after barely a year in the market. The remaining Apple Watch models have reportedly outsold all Swiss watch brands combined for the past four years. Yet, on the basis of Strategy Analytics’ estimates, Apple’s revenue from its smartwatches would total $US6.1–15.3 billion ($AU9–23 billion) – significantly less than the Swiss watch industry at $AU37 billion. |

Read Full Feature in eMag

Download PDF »