Fob watches were invented in the late 19th Century and wristwatches followed at the beginning of the 20th Century and by 1930 they were outselling traditional fobs.

Fob watches were invented in the late 19th Century and wristwatches followed at the beginning of the 20th Century and by 1930 they were outselling traditional fobs.

But both were made in Switzerland and mostly by hand, making them hugely expensive and limiting ownership to royalty and those with considerable wealth.

Annual sales of watches increased modestly in the ensuing decades – until the late 1960s and early ’70s, when Japanese manufacturers Seiko and Citizen triggered a global boom and caused a paradigm shift.

Three factors tipped the balance, allowing the Japanese to take the market by storm and almost destroying the Swiss watch industry in the process:

- They invented the quartz movement

- They designed and built new machinery for the mass production of watch movements and components

- They had access to cheap labour for low-cost assembly

For the first time in history, reliable and accurate timepieces were affordable. The response was overwhelming: everyone wanted and needed a watch, and now they could own one.

Since then, the world has experienced massive advancements in technology and an explosion of consumer products, appliances, and devices. Everything from ovens to televisions, telephones and remote controls now provide consumers with accurate-to-the-second timekeeping.

The fact is consumers no longer need a watch to know the time and more of them are choosing not to wear one. So, is time running out for watch retailers?

I raised this question in an article published by Jeweller in 2012.

Drawing on more than 20 years of industry experience – including as chair of the Timepiece Council – along with the findings from research conducted by Citizen while I was regional managing director, I offered five recommendations to help retailers maintain and increase sales of watches.

Reviewing the framework for success

• Stand out from the crowd – To attract customers you need to look and act like you are in the watch business. This does not require dedicating half the store to watches or stocking umpteen different brands.

Choose the number of brands appropriate for the store and allocate funds to promoting them well.

Be prepared to commit space, invest in stock, and honour a replenishment agreement with supplier support

Take the opportunity to explore options like a shop-in-shop fit-out/display as well as an end-of-season balance- back of discontinued and slow-selling models. Doing so can make your store a primary destination for the brands you sell.

• Engage and reward – Fewer people are buying watches. But those who are do so more often. It therefore makes good business sense to identify these customers and understand their reasons for buying; are they a collector, a follower of fashion, or are watches their preferred gift for loved ones?

Many retailers have forgotten that it is far more economical to keep an existing customer than it is to find a new one – but it takes work to keep them.

Maintaining client cards or VIP lists is a great step but meaningless if you fail to do anything with them. If kept up-to-date, they provide the means to engage and reward regular clients who spend and who are more likely to bring like-minded customers to your store.

• Focus on gift giving – Approximately 60 per cent of annual retail sales of watches occurs in the eight weeks before Christmas, and throughout the year as many as seven out of 10 watches are purchased as gifts. Therefore, anything that enhances the gift-giving experience is likely to have a positive effect on sales.

Have you tried to gift wrap a watch box lately? Despite the fact most are square, they are not easy to wrap, and you are left with excess and wasted gift-wrap.

The offer to wrap watches purchased as gifts as a complementary service – even if only for VIP customers – will do wonders for goodwill and repeat business.

• Plan for success – Success requires more than good luck; it requires a well-thought plan and a structured approach. This begins with the process you adopt for choosing the brands to stock and determining what will differentiate your business from competitors.

Once chosen, you can draw on the support of suppliers with a written agreement that details what each party has committed – this should include expert product education, a minimum level of order fulfillment and a contribution to marketing activity.

• Be prepared for failure – Regardless of the effort made, it is fair to say few things in life go without a hiccup. The fact is, things do go wrong so, for any number of reasons, a brand may not perform to expectations.

If this happens – and it will – you must be prepared to replace it with a better option and to do so quickly.

You need to monitor your own sales as well as the brand’s sales performance in your state and nationally. Ensure written supplier agreements enable quick termination, keep your finger on the pulse, and have at least two brands on standby.

Eight years on and the world has changed. In this new COVID-19 reality, retailers can no longer rely on passing trade for a continuous flow of store ‘traffic’ or highly trained sales staff to convert this traffic into sales.

Success now depends heavily on the retailer’s website. However, just because a person has visited your store or made a purchase in the past is no guarantee they will buy from your website. It simply increases the chance of being considered. To be successful, a website must capture the attention of online shoppers and compel them to buy.

Competition is far greater online and customers can shop around from the comfort of their own home. Additionally, they can easily be tempted to switch from a retailer they know and trust to an unknown if it will save them a few dollars. It’s hard to find any traditional bricks-and-mortar retailer that has risen to the challenges of selling online, as proven by the meteoric rise of Amazon.

To be successful online, you need to be competitive on price but more importantly you must have a point of difference. If your website is not designed to promote and exploit this difference then you won’t stand a chance.

If your strategy is short term and your approach is simply to offer the lowest price, then your trading will be based on the lowest common denominator. I say short-term – because in my experience, there is always someone prepared to take a few more dollars off just to get the sale.

Adapting the framework

With all this in mind, it is now critical to assess the websites of watch retailers – both independent jewellery retailers, department stores, and e-commerce businesses – based on these five recommendations.

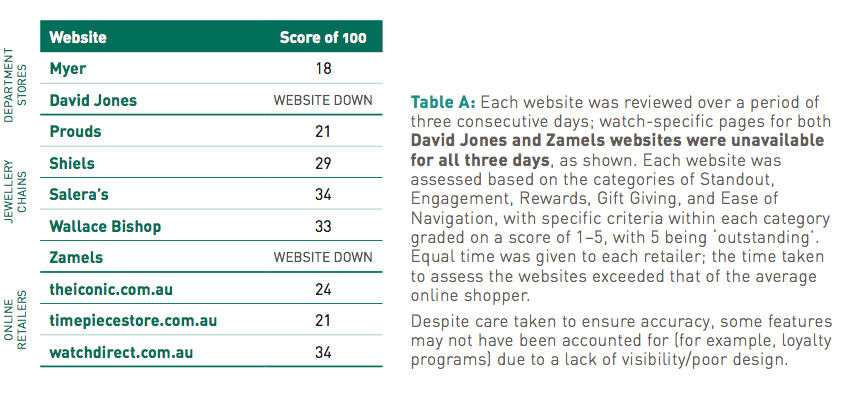

For the purposes of this analysis, I examined 10 retailers: Myer, David Jones, Prouds, Zamel’s, Shiels, Salera’s, Wallace Bishop, WatchDirect.com.au, TheIconic.com.au, and TimepieceStore.com.au.

However, before assessing the retailers, we need to acknowledge two conditions that apply to the watch industry and understand their implications.

However, before assessing the retailers, we need to acknowledge two conditions that apply to the watch industry and understand their implications.

First, the industry is in transition from a ‘needs’ business – where demand was driven by the necessity of owning a watch – to a ‘wants’ business, where demand is driven by the desire to wear one.

Secondly, a watch is an item of ‘conspicuous consumption’ – a term that applies to goods and services that when publicly displayed show one’s social status, economic wealth, and taste for luxury. Worn to be seen, a watch communicates a great deal about the person who wears it, including their lifestyle, income level, if they are conservative, contemporary, or ultra-modern, and even the type of work they do.

For these reasons, marketing watches in the context of lifestyle is likely to be far more effective than positioning them as a purely functional product. This is best achieved by leveraging the marketing that brands are already doing themselves, and creating marketing materials and messages that tap into the emotional experience associated with a lifestyle, for example, capturing the thrill of diving and connecting it to a dive watch.

A website is equivalent to a store and the product pages are equivalent to a window display. Therefore, many of the same rules of retail apply.

However, websites require extra attention because unlike a visitor to a store, a visitor to a website doesn’t have the benefit of a trained sales specialist to greet, engage and provide them with great service – the website must do all that and more.

My review was based on a structured assessment of five categories: 1) standout, 2) engagement, 3) rewards, 4) gift-giving and 5) ease of navigation, with a possible total score of 100. Further details of the methodology, and final scores, can be found in Table A.

Stand out from the crowd

For a website to stands out it must be noticeably different and distinguished from all others. It needs to grab the browser’s attention and catch their eye.

For the purposes of this evaluation, I considered the overall design and first impression.

Points were awarded for the use of images and videos, as well as the appearance of products and the information provided. Each site was scored out of 35. The results were disappointing. None were eye- catching and there was little to differentiate

one from another.

The David Jones and Zamel’s sites were both ‘down’ at the time of assessment, and of the remaining eight, the overall standard was poor. Salera’s received the highest score of 17 and Myer scored the lowest at six. Surprisingly, online-only retailers fared no better than omnichannel stores.

Overall, retailers failed to capitalise on the marketing investment made by the individual brands and most didn’t even use the current advertising images for the brands they sold.

And considering video content is one of the most effective ways to engage potential customers online, only one out of 10 retailers used brand videos – and even then, only for a few brands!

There can be no argument to the fact that a watch is a lifestyle purchase. Despite this, lifestyle photos were rarely used – and instead of promoting recognisable brands that attract customers, some websites used pictures of generic watches for their key images.

Given that online customers are unable to hold a watch or try it on, they at least deserve a 360-degree view of the product – but many retailers simply used the images provided by suppliers, and these vary enormously in quality and style.

As a result, the websites showed a hotchpotch of product images that ranged from 2D ‘pack-shots’ to multiple images taken from different angles.

Even though virtual ‘try it on’ software is available and used by other industries like sunglasses, watch retailers are yet to adopt it.

The same scattergun approach appeared to be taken when it came to product information. Whatever happened to using a standard set of icons with a reference chart? Do retailers believe that online customers don’t warrant the effort?

Of the sites reviewed, none were visually exciting, inspiring, or appealing. They simply presented products like soldiers in a row, compelling me to shop around for the lowest price and the best first- order discount.

Engage the shopper

When a customer enters a store, they’re usually greeted and engaged in conversation. This exchange provides the opportunity to connect, learn more about them, share knowledge, and then offer products to meet their needs. It’s also a chance to make a positive impression and establish a long- lasting relationship.

Although a website can’t replace the ‘human touch’, it can be designed to deliver the same outcomes. But this requires the ability to see life through the eyes of your customers and to consider what value you can add.

“Fewer people are buying watches. But those who are, do so more often. It makes good business sense to identify these customers and understand their reasons for buying; are they a collector, a follower of fashion, or are watches their preferred gift for loved ones?”

The effort made to engage customers is a clear indication of whether a company is focused on short- or long-term objectives. When engaged, customers are more likely to have a positive opinion and to return to the retailer.

Websites were given a score out of 30 for engagement. Access to information that clearly articulates the product’s benefits and helps with decision-making is one way of engaging customers – for example, water resistance, band adjustment, benefits of ion-plating, and/or key materials and manufacturing standards.

Chatbots, customer reviews, links to brand websites and an active and informative blog are other ways to engage with shoppers.

When it came to engagement, the results were shocking. Once more, the David Jones and Zamel’s sites were both down. Scores ranged from one (Myer) to seven (Salera’s) out of 30, with online-only stores scoring no better than traditional retailers.

While many sites allowed customers to search according to construction material, none provided any explanation. It was the same with water resistance – with the potentially dangerous discovery that most, if not all, sites featured watches that appeared to be suitable for diving, but were not.

It’s hardly surprising that consumers are confused when a respected retailer such as Wallace Bishop uses the following scale: 100M, 10M, 200M, 300M, 30M and finally 50M.

While many sites publish customer reviews – neither Salera’s nor Myer appeared to have any. Shiels was the only one to offer a reward for reviews, however I challenge the logic of combining a review of a product with a customer service testimonial.

Rewarding customers

The definition of a reward is ‘a benefit received after a specific action or behaviour, or gifts that acknowledge and benefit people for their actions’.

To be effective, a reward must have value and a direct link to the desired behaviour. Rewards are a proven method of encouraging customers to buy – and to buy more often. They also provide a competitive advantage for one retailer over another.

Material goods are not the only rewards to which consumers respond; acknowledging loyalty with VIP client status/benefits as well as providing exclusive additional services – such as advance notice of sales events, free delivery, special discounts, and access to privileged information – have proven just as successful.

Websites were scored out of 10 with a maximum of five for a loyalty program and five for providing a gift with purchase or other exclusive offers. It seems retailers are not keen to reward customers with all sites scoring 0 – except for Prouds and Wallace Bishop.

While both have VIP programs, they provided no information on how to qualify or the rewards on offer. How would you benefit from buying watches? – they kept this to themselves.

Emphasis on gift-giving

It’s important to remember the primary reason for buying a watch is gift-giving which is why many brands invest significantly in packaging. Simply showing the gift box for the brands they sold would earn a retailer five points with another five for offering gift wrapping, coming to a total score out of 10.

Of all the sites, only Watchdirect.com.au made any effort and scored 3. They showed the gift box of some brands – but not all – and managed to get some of those wrong! As for gift wrapping, not one retailer offered that service, free or otherwise.

Structured for success

The ‘plan for success’ recommendation in the 2012 article is difficult to judge objectively. To do so I developed a new metric – one that assessed the structure of the website itself. Consideration was given to ease of navigation, layout of products, and brand identification, with a maximum score of 15.

Again, neither David Jones nor Zamel’s was open for business, but the other eight sites all scored well. Prouds scored the lowest with 9 and Watchdirect.com.au scored the highest with 13.

As you might expect, the online stores scored highest, but all were weak when it came to brand identity. Simply having the brand logo appear beside the watch and the brand name appear on a separate line and in a different colour would be a simple fix.

Concluding thoughts

Based on these results, it’s fair to say if any retailers listened to the advice given in 2012, they did not heed it.

While I’m accustomed to retailers believing they know better, it’s surprising to see so many have ignored the basic principles of retail, common sense, and logic.

Unless they get serious and put some thought and investment into how they sell watches online, retailers may end up like the taxi industry after the launch of Uber – fighting for their livelihood because a growing number of consumers no longer consider them relevant.

Fail to act and watch retailers could find themselves competing against more and more watch brands selling directly to consumers – and doing a much better job of it than they do.

Read eMag