Our office secretary was overjoyed. The right man had finally popped the question and sealed it with a beautiful diamond ring. She showed it to all her co-workers. In the centre was a large lab-created diamond, surrounded by dozens of small natural diamonds.

What would you call such a piece of jewellery? Is it mostly natural, partly lab-created, mixed, or something else entirely?

In our latest pipeline report, we are adapting to reality and coining a new term - hybrid diamond jewellery – to describe a piece of jewellery that features both natural and lab-created diamonds.

To ensure transparency and maintain consumer trust, it is essential for retailers to offer a choice between three types of diamond jewellery: natural, lab-created, and hybrid.

The popularity of hybrid diamond jewellery will slow the pace of expansion for pure lab-created diamonds, offering a transparent in-between alternative.

The hybrid label could herald the end, more or less, of the undisclosed lab-created that have tarnished the reputation of the entire diamond market.

De Beers’ Lightbox brand may maintain its niche in the more affordable ranges. Hybrid diamond jewellery is already becoming a niche of its own. And it’s a beautifully appealing niche - just ask our delighted office secretary.

Hybrid jewellery allows retailers to cater for a range of consumer preferences while maintaining trust in their products.

Our industry is changing fast, and we are responding to that change by splitting our diamond pipeline for 2022 into two separate pipelines – natural and lab-created.

The gemstone-quality lab-created diamond business is now a distinct, separate and expanding part of the industry. We believe it is important to differentiate accurately between the natural and gemstone-quality lab-created diamond pipelines.

Chaim Even-Zohar published his first Tacy Pipeline back in 1988. Under the new management of Pranay Narvekar, we are embracing new realities.

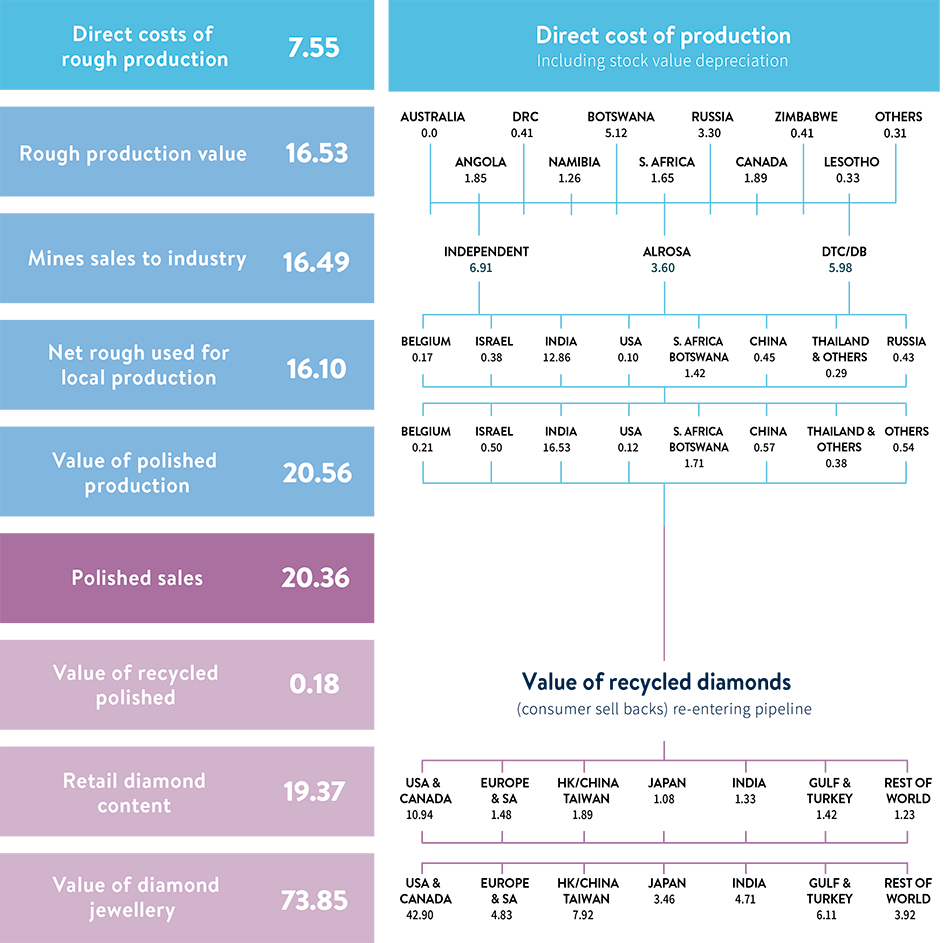

The natural diamond jewellery retail market in 2022 totalled $US73.85 billion ($AU110.72 billion).

The lab-created retail market mushroomed to $US12.24 billion ($AU18.35 billion). We can’t say exactly what share hybrid diamond jewellery represents out of the $US86.09 billion ($AU129.07 billion) global diamond retail market, however; we do know it’s expanding.

Diamond content in a natural diamond jewellery piece represents 25 per cent of the retail price, compared with 17 per cent in lab-created diamond jewellery, according to our Pipelines. We estimate a figure of around 20.5 per cent for hybrid pieces.

We believe the hybrid diamond jewellery market, at retail polished values, is worth $US2.2 billion ($AU3.3 billion) to $US2.6 billion ($AU3.9 billion).

It could be more, however; certainly not less. Most of that is from lab-created companies seeking to ‘upgrade’ their product for marketing purposes.

That would value the diamond jewellery retail market at around $US73 billion ($AU109.4 billion), lab-created diamond jewellery retail sales at $10.69 billion ($AU16.02 billion), and 2022 hybrid diamond sales at $2.4 billion ($AU3.6 billion).

Transparent third category

Diamond jewellery is part of a global jewellery market that’s increasing at eight per cent per year. Are we maintaining or increasing our share in that total pie? Or are we outpacing that expansion?

The advent of lab-created means we no longer need to be preoccupied with the traditional constraints of limited natural production.

We should be honest enough with ourselves to recognise that and turn the new reality to our advantage.

If we assume the global jewellery market is worth $US210 billion ($AU313.9 billion) to $US220 billion ($328.8 billion), and the global diamond jewellery market is estimated to be 40 to 50 per cent of that amount, the global diamond retail market should be in the range of $US80 billion ($AU119.6 billion) to $US110 billion ($AU164.4 billion).

Our two pipelines put the 2022 total at $US85.57 billion ($AU127.92 billion). We recognise that we have, over the years avoided overstating the facts we find.

It could be more, but certainly not less. Our hybrid diamond jewellery category would bring greater transparency for more than one reason.

The presence of undisclosed lab-created diamonds in the market has inflated the apparent size and value of the natural diamond market, as some lab-created diamonds are sold at natural diamond prices.

We hope the new hybrid classification will motivate diamantaires, when doing a cost-benefit calculation versus the risks taken, to lower the volume of undisclosed lab-created sales.

US customs authorities require invoices for jewellery imports to include a breakdown of natural and lab-created diamonds. A retailer will instantly know that it’s hybrid diamond jewellery.

The term is catchy, almost sexy, and currently very fashionable. Organisations fighting the lab-created market may not be happy, however; eventually they’ll come to realise that the hybrid diamond jewellery label provides added transparency and disclosure.

And what about mixing with other gemstones? That can never be called hybrid diamond jewellery, a term that must be reserved exclusively for a mix of natural and lab-created diamonds. Nothing more. Nothing less.

While most, or many, consumers may continue to prefer jewellery containing only natural diamonds, others might appreciate the cost savings and ethical advantages that come with incorporating lab-created diamonds.

Lab-created volumes or sales exceeding those of natural diamonds is an inflection point for the business.

The tipping point is consumers losing confidence in diamonds as a luxury product – leading to the eventual demise of the diamond dream.

That’s why our office secretary is so happy with her hybrid diamond ring.

Macro and transition

Retail demand for diamond jewellery has been fueled in recent years by the US government’s $US5.7 billion ($US8.5 billion) COVID-19 stimulus.

More than half was handed out in 2021, driving demand for all goods, not just diamonds, well into 2022.

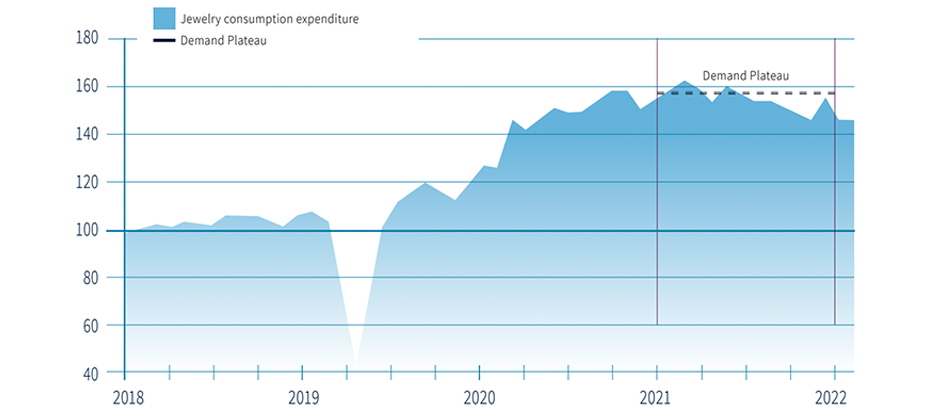

Data from the US Bureau of Economic Analysis clearly shows a year-long plateau in US diamond jewellery sales from September 2021.

Sales then started to decrease and are currently about seven per cent lower, a decline that was apparent by Q3 2022.

The authors have written previously about the expected slowdown in the US retail jewellery market and its impact on rough and polished diamonds.

Demand actually exceeded expectations and the decline was lower than expected. Banking experts estimate that the US consumer used the stimuli to increase savings, however; those savings are expected to run out by the end of 2023.

|

JEWELLERY CONSUMPTION EXPENDITURE INDEX |

|

| Demand actually exceeded expectations and the decline was lower than expected. Banking experts estimate that the US consumer used the stimuli to increase savings, but those savings are expected to run out by the end of 2023. |

| Source: Bureau of Economic Analysis, US Department of Commerce |

|

Natural diamond pipeline

High inflation, coupled with low unemployment, buoyed the jobs market in the US, despite the US Fed increasing the interest rate by a record 4.25 per cent in 2022.

Inflation and salary increases boosted consumer confidence. Overall jewellery demand increased by about three per cent, however; demand for natural diamond jewellery actually declined.

The US dollar also strengthened significantly during 2022, with the dollar index being up about 12 per cent for the year. A higher US dollar adversely affects demand from countries with currencies not pegged to the dollar.

Together they represent 35 per cent to 40 per cent of total demand. In China and Hong Kong, demand for jewellery was severely affected by lockdowns imposed as part of the government’s zero COVID-19 policy.

The overall economy also faced headwinds, as imports into the US were affected by both the increasing tensions between the country as well as lower export orders due to geopolitical uncertainty.

Hong Kong also had far fewer tourists from mainland China. Overall the market in the region contracted by nearly 20 per cent.

India was one of the bright spots, with the market increasing by nearly seven per cent. The economy remained strong, despite a weak rupee.

The overall global jewellery demand remained positive - about one per cent higher at $US86.09 billion ($AU128.7 billion) - despite weakness in some countries.

In the first couple of months of 2022, rough and polished demand and price increases rivalled those seen in the first half of 2008 and 2011.

However, these increases were clearly market exuberance. The market for natural polished diamonds actually decreased as demand for lab-created jewellery cannibalised natural diamond demand.

“Our industry is changing fast, and we are responding to that change by splitting our diamond pipeline for 2022 into two separate pipelines – natural and lab-created.”

After accounting for the bull-whip effect of stocking, polished demand declined by about eight per cent to $US20.36 billion ($AU30.52 billion).

Fragmentation of rough supplies

The Ukraine war, and the subsequent sanctions on Alrosa, helped the industry digest the excess purchases in the first couple of months as rough supplies were interrupted.

As the industry recovered and new supply mechanisms from Russia were developed, the market was able to accept the supplies.

Rough diamond supplies, which had been very global in nature before the war, started to become fragmented.

Large clients, based on political or societal compulsions, started asking mid-stream suppliers to ensure there were no diamonds of Russian origin in the goods supplied to them.

The sword of sanctions by the G7 continues to hang over the industry to date.

This provided a boost for proponents of traceability and origin within the industry, which we believe remains an issue of cost.

It will cost the midstream $US1 billion ($AU1.5 billion) to $US1.5 billion ($AU2.25 billion) to implement it across the pipeline.

Small diamonds remain the challenge, mainly due to the sheer volume, with an estimated billion such diamonds polished every year.

Customers willing to pay the price will be able to get the transparency they desire.

Overall, total rough production during 2022 was more than 125 million carats, with both De Beers and Alrosa increasing production for their respective reasons.

In terms of value, total mine sales were about $US16.49 billion ($AU24.72 billion) or about 6.6 per cent above those in the previous year.

Polishing started to become unprofitable by the second half of the year, as demand declined.

After a highly profitable 2021, polishers were able to sustain some rough buying, in the hope that prices would moderate.

This weakness continued into 2023, as polishers eventually started to reduce the amount of natural rough they put into production.

|

NATURAL |

TACY'S 2022 DIAMOND PIPELINE IN $US BILLION |

|

| Feature first published by IDEX Online. © 2023 Copyrights by Tacy Ltd. and Pharos Beam Consulting LLP Strictly Reserved. |

| Republished with permission from Pranay Narvekar |

|

From supply led to demand-driven

The structure of the lab-created industry is much more vertically integrated than its natural counterpart.

Most of the new chemical vapour deposition (CVD) capacity in India is by companies already in the natural diamond business.

They polish most of their own rough, as opposed to CVD producers in other countries, which sell their rough to Indian polishers.

High pressure high temperature (HPHT) technology-based rough is predominantly used for small diamonds in China, which has the infrastructure to produce industrial-quality diamonds.

Companies with distribution capabilities not only polish their rough, they also produce and sell jewellery, set with their own lab-created products, direct to retail companies.

In many cases sales are on memo, as retailers are averse to taking risks with lab-created stocks.

This vertical integration also means values are more dependent on internal transfer prices within the companies as they move through the various stages of production and jewellery.

As a result, we have skipped a few stages in our lab-created pipeline.

The lab-created industry had its own transition during 2022, shifting from a supply-led industry to a demand-driven one.

“The term is catchy, almost sexy, and currently very fashionable. Organisations fighting the lab-created market may not be happy, however; eventually they’ll come to realise that the hybrid diamond jewellery label provides added transparency and disclosure.”

In 2020 and 2021 the lab-created segment was increasing its market share, as the market ballooned, leading to explosive expansion.

It sold almost everything it could produce during those years. Companies that had taken the leap of faith and invested in lab-created technology 3-4 years prior benefitted from that expansion.

By mid-2022, just as the retail increase in the US plateaued, lab-created production capacity improved as penetration in retail stores started to slow.

More than two-thirds of stores began carrying lab-created diamonds, leading to slower stocking demand.

The bull-whip effect of the slowing stocking demand further impacted demand for polished lab-created diamonds.

Prices across all polished lab-created categories declined as a result by about 50 to 65 per cent during the year.

The US accounted for more than 82 per cent of the retail lab-created jewellery market. While it is the main market for natural diamonds as well, the lab-created market share reached about 19 per cent.

It was initially expected that lab-created diamonds would fit into the fashion jewellery market, however; that wasn’t the case. They penetrated the bridal jewellery market first, driven by ever larger diamonds produced using the CVD technology.

Lab-created demand in other countries is still nascent. Consumers in China and India put more emphasis on the resale value of the product, and have yet to wholeheartedly adopt the lab-created category.

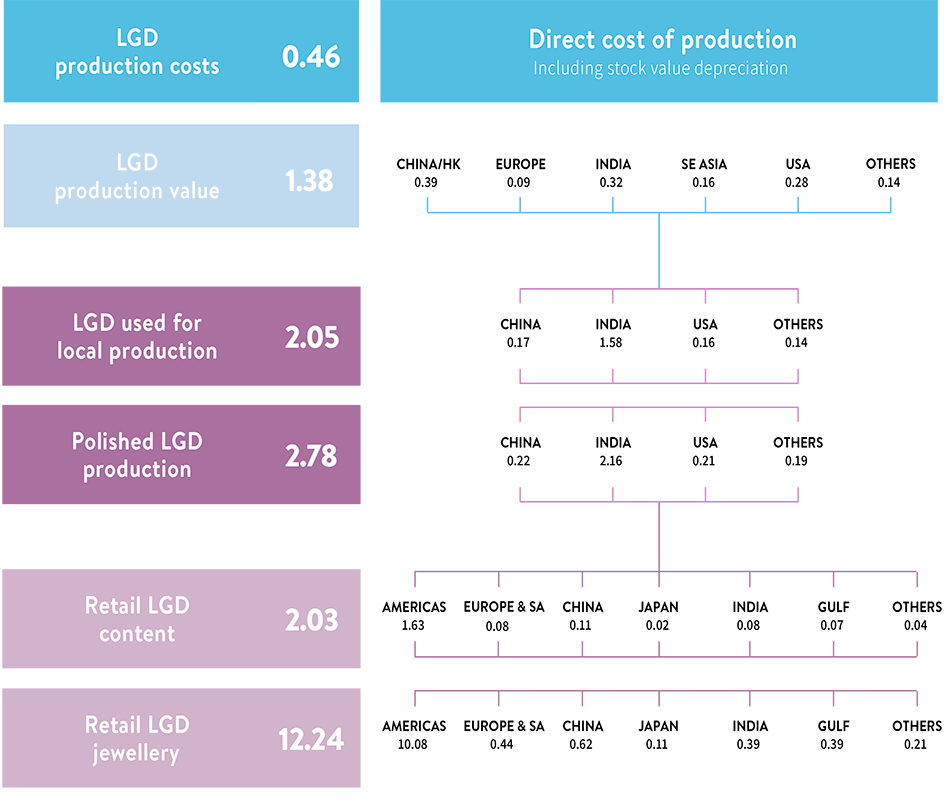

Overall, the retail jewellery market for gemstone quality lab-created diamonds is estimated to be about $US12.24 billion ($AU18.35 billion) or about 14 per cent of the total global retail jewellery market.

The total value of lab-created diamonds which was polished globally is estimated at around $US2.78 billion ($AU4.17 billion), with most goods polished in India due to the lower labour costs.

Most smaller diamonds are polished in India, although a few producers polish larger diamonds elsewhere.

Gemstone quality rough producers are more evenly distributed. China produces the most carats due to its greater reliance on HPHT technology.

India has seen some of the largest investment in new CVD capacity, with many natural diamond companies diversifying into lab-created diamonds.

Indian banks have also been more open to financing the establishment of lab-created production facilities.

US production is dominated by three or four companies, including De Beers, which has its facility there. These companies currently seem to be the leaders in terms of production technology.

Gemstone quality lab-created production is estimated at $US1.38 billion ($AU2.07 billion). There could be valuation differences in this estimate, as in many cases these are internal transfers with the companies.

Total lab-created production is estimated at about 26 to 28 million carats. The authors have previously stated their strong belief that lab-created diamonds are not a typical ‘diamond business’ and that regarding them as a separate business could lead to better management.

As the lab-created market transitions from a seller’s market to a buyer’s, extra-normal profits from the lab-created pipeline will disappear, leading to eventual consolidation within the sector, as companies combine to stay afloat and stay relevant.

Vertical integration can maximise the benefits of planning efficiencies.

Lab-created industry – victim of its own success

In the US bridal market, retailers sold larger lab-created diamonds as a same-price alternative to smaller natural diamonds.

Retailers were able to capture the same consumer spend while making much better margins -up to 70 per cent - on the products.

|

LAB-CREATED |

TACY'S 2022 DIAMOND PIPELINE IN $US BILLION |

|

| Feature first published by IDEX Online. © 2023 Copyrights by Tacy Ltd. and Pharos Beam Consulting LLP Strictly Reserved. |

| Republished with permission from Pranay Narvekar |

|

Happy customers felt they’d got an upgrade. That explains how lab-created diamonds have penetrated more than 25 per cent of the bridal market, however; this approach can cause longer-term problems.

As lab-created diamond prices continue to fall, retailers now need to sell bigger lab-created diamonds than in the past year – to reach a similar transaction dollar value.

This has the potential to leave older customers very dissatisfied. Retailers who may have made false promises about lab-created diamonds should beware.

It may not take long for some enterprising lawyer in the US to file class action lawsuits against retail jewellery companies for mis-selling lab-created diamonds.

Retailers have also benefitted from a decline in wholesale lab-created prices, leading to better margins.

In 2023, price wars are likely to extend into the retail space. All you need is a large retailer or online seller to come out with aggressive price points for lab-created staple products, such as studs or solitaire rings, to trigger a price war.

Ultimately, retailers focus on their gross margin per square foot. Slashing prices, even with better margins, means they’d need to sell many more pieces to make up for the loss in value.

This might not be easy, especially when highest value sales have been in bridal jewellery, and a decline in weddings and engagements is expected this year.

Lab-created jewellery margins and profitability ratios are likely to achieve parity with natural diamond jewellery within a couple of years, however; retailers will now need to sell much higher volumes (or significantly larger sizes) to even maintain their gross income.

There was great fear and anxiety in 2014-2016, as parcels of natural diamonds ‘peppered’ with lab-created diamonds started appearing in the midstream.

With the advent of reliable and affordable detection machines, those fears and anxieties subsided. De Beers’ Lightbox foray gave the lab-created industry the credibility it craved and opened up the path to the expansion witnessed in the past few years.

Companies that started dealing in lab-created diamonds and jewellery are now seen to have made a smart choice.

Disclosed lab-created diamonds are now part and parcel of an industry that has passed its inflection point.

In fact, the production volume of polished lab-created diamonds under 0.2 carats, such as pointers and above sizes, exceeded the production of polished from natural diamonds for the first time in the past year.

Market increases in 2021 masked the real damage it had suffered – something the authors lamented in the 2021 pipeline report.

The diamond industry was, at the time, living in the hope that lab-created diamonds would find their own level in the market both in terms of price and market segment. And that natural and lab-created diamonds could co-exist and expand in their respective areas.

Was this consensus view realistic, or were the initial fears and anxieties actually justified?

The diamond market, both natural and lab-created, is based on the fundamental assumption that consumer desire for diamonds will continue.

That desire stems from the perception of diamonds as a luxury. Given the current situation, we need to question whether that perception of diamonds will continue in the future.

Natural diamonds have always been seen as a symbol of luxury. The biggest and the brightest of them have been flaunted by royals and celebrities, and wars have been fought over their possession.

"Large clients, based on political or societal compulsions, started asking mid-stream suppliers to ensure there were no diamonds of Russian origin in the goods supplied to them.”

Diamonds became the leading symbol of wealth and power, the ultimate social signifier.

This aspirational nature of diamonds was cultivated by De Beers through more than 80 years of marketing campaigns and by limiting supplies through the cartel system, as limiting the supply of products is equally important to retain their perception of luxury.

Establishing a bond between diamonds and emotional moments in the consumer’s life, together with the ‘three months’ worth of salary rule’ for wedding rings cemented their position as a social signifier.

The wider availability of smaller and lower quality diamonds, the so-called Indian gemstone quality, democratised diamonds, however; larger and higher quality stones retained their luxury appeal due to continued scarcity.

Just as luxury brands offer lower-priced accessories so that consumers can experience the brand, lower-priced jewellery allowed consumers to experience and build up their diamond dream.

The size and quality of diamonds worn became a social signifier. The industry has been confronted with the vagaries of demand and supply in the past two decades since the De Beers cartel dissolved.

Diamond prices initially stagnated and have actually fallen by more than 25 per cent since their 2011 peak, despite pandemic-induced price increases.

Lab-created inroads to the larger diamond market have threatened the very status of diamonds as a social signifier.

Our office secretary was overjoyed with her hybrid jewellery, and would even have been smiling with lab-created jewellery.

Lab-created have made large diamonds accessible to the middle classes, and in doing so they have challenged the very notion of diamonds as a social signifier.

This will have implications for not only natural diamonds but the lab-created category as well. We believe that in the next year or two, consumers will be able to purchase a pair of earrings – each with two five-carat solitaire lab-created diamond studs – for less than $US2,500 ($AU3,741).

The natural diamond equivalent would cost 100 times as much at today’s prices.

One only has to look at what happened to Coach handbags or Ralph Lauren clothing when they became more widely available - regarded simply as a premium product - rather than a luxury.

Such easy availability could threaten the very notion of a diamond being a luxury.

To again quote from the Kapferer and Bastien book: “Luxury objects are objects of luxury brands. Only diamonds are luxury objects appreciated without brand.

"What counts is their size and purity. For everything else, there is no luxury without brands: even an emerald is from Colombia, a ruby from Burma, a caviar from Iran.”

The worst-case scenario is that we reach a point when any diamond jewellery is automatically assumed to be lab-created.

Without visible branding, the diamond would have no aspirational value. Will celebrities still want to flaunt their diamonds when they no longer signify wealth?

Will our secretary still be as pleased to get hybrid jewellery? Will this be the end of the diamond dream?

Stores closing, business shrinking

The impact of the tipping point - diamonds not being considered a luxury by consumers - will be felt right across the chain, from retail to rough and by both the natural and lab-created diamond pipelines.

Consumers will still buy diamond jewellery, both lab-created and natural, however; price points and volumes will be much lower. Consumer desire for natural diamonds will shrink.

Most buyers will be perfectly comfortable buying lab-created jewellery, with price points similar to other accessories.

Many retailers would, as a result, end up selling predominantly lower-priced lab-created jewellery.

They’d need to sell far higher volumes to achieve the same gross margin dollars. This would pile the pressure on retail jewellery stores and could spur a fresh round of closures in the US.

In China and India, the retail impact would be less severe, as they mainly sell gold jewellery.

Luxury brands would continue buying natural diamonds and paying the prices.

Maintaining their image and the perception that they use only the best materials would outweigh any savings.

|

| De Beers' Lightbox |

This loyalty to natural diamonds would account for only a fraction of the total supply and only in very specific areas.

In extreme cases, there could be a single flat price for polished diamonds, regardless of whether they’re natural or lab-created.

Certifying lab-created diamonds would become irrelevant and the business of certifying larger natural diamonds would also shrink.

With average prices at $US150 ($AU224) per carat or less, it would be uneconomical to certify polished lab-created diamonds.

The mid-stream may, at least superficially, appear to be the most resilient. All diamonds, regardless of origin need to be polished, however; that may not be the case.

The cut-throat competition for lab-created product may bring down labour costs, with a per-piece rate above a certain size.

With low rough prices, speed and cost become much more important than polishing yields.

Machines would be used to polish CVD stones and the lower volume of natural diamonds would not be able to sustain the existing number of polishers.

Mining would see the greatest disruption. Mines with high operating costs or a product mix skewed towards smaller diamonds would face closure, leading to a decrease in natural carat production.

“By mid-2022, just as the retail increase in the US plateaued, lab-created production capacity improved as penetration in retail stores started to slow.”

It would become impossible to finance new mines or upgrade older mines, leading to the gradual tapering in natural diamond production. Recycling of diamonds from consumers could become the ‘largest mine’.

Laboratories too, would have to compete to ensure the lowest cost of production or be priced out of the market. Over time, creating diamonds would adopt a cost-plus model for the pricing of rough.

This is an extreme ‘nightmare’ scenario. The reality may not be quite so bad, however; it could well be worse than our existing assumptions.

2023 projections

In 2022, we forecast tough times for the industry and we believe the rest of 2023 will be difficult, however; we predict some respite in Q4.

Assuming a mild US recession and a flat Chinese market, we expect the global natural diamond jewellery market to slow by five per cent.

To put this in perspective, the 2008 crash saw retail demand decrease by 10 to 12 per cent globally. A deep US recession, rather than a mild one, could be catastrophic.

A five per cent decline in global natural diamond jewellery translates into a decrease in polished demand of 11 per cent - or about $US18.1 billion ($AU27 billion) in sales.

This also means that the rough market will be down by nearly 20 per cent - to about $US13 billion ($AU19.4 billion) of rough sales.

The industry should batten down the hatches and wait out the storm.

We believe mines currently have built-up stocks of about $US1 billion ($AU1.5 billion). They would need to decrease prices or reduce production to work through those stocks.

Concluding remarks

The current fall in demand for diamonds is nothing but a market cycle, albeit a severe one.

The industry shored up its balance sheet during the past few years and should be able to weather the downturn - unless there’s a severe recession.

For the lab-created industry, this is the first downturn in its relatively short life.

It might be more difficult for companies that have either invested heavily or are leveraged.

Margins will continue to come down and are likely to remain low. Lab-created retailers in the US will probably face their year of reckoning, as falling prices erode top lines.

The real concern remains whether customers will continue to perceive diamonds as a luxury.

That is why we believe that our third category of hybrid diamond jewellery may halt, or even reverse the erosion of faith in our product.

If that faith wavers, both the natural and lab-created industries will suffer.

The day when consumers no longer aspire to own a diamond, if it ever comes, would be the death of the diamond dream.

Read eMag