Daniel Wellington will enter next year with a renewed focus on the Australian retail market after putting pen to paper on an exclusive distribution partnership with Duraflex Group Australia.

To say that the past 13 years have been a rollercoaster ride for the proudly unassuming Swedish watch brand is an understatement.

In 2006, founder Filip Tysander was backpacking in Australia and encountered a fellow traveller named Daniel Wellington. A wristwatch worn by the Brit caught the eye of Tysander – it was a Rolex Submariner secured by a sleek black-and-grey nylon band.

By chance, the pair would cross paths multiple times while down under, and on each occasion, Tysander became more enamoured with the watch.

When he finally returned to his hometown of Uppsala in Sweden, Tysander was obsessed with launching his watch company. Action was finally taken in 2011 when he founded the company with an initial investment of approximately $AU30,000.

Launching a new watch or jewellery brand is a daunting task. Fashion is a fiercely competitive market – capital investment and advertising costs are significant, rivals and imitators frequently haunt successful brands, and consumers are often fickle.

Tysander was unphased by all of these challenges. By 2014, Daniel Wellington was named Europe’s fastest expanding company, with more than one million units sold and revenue in excess of $US70 million.

In the media, critics have often potted Daniel Wellington for its aesthetics. An article published in Bloomberg once described the watches as ‘instantly recognisable, and so generic they verge on invisible.’

What these critics could not overlook was the most critical factor – Daniel Wellington was popular. The following year, revenue of more than $US220 million was realised.

On an unexpectedly warm spring morning in Melbourne, global offline director Joakim Levin reflects on this early success and attributes it to three key factors.

“We were one of the first watch brands to embrace influencer marketing, and in the early days, we put every single penny we had into marketing and advertising,” he tells Jeweller.

“Marketing via influencers was a crucial point of difference. At the same time, we secured partnerships with strong distributors – first in Scandinavia, then in Europe, and then the rest of the world.

“Then there’s the product itself – a sleek and minimalistic design that the market was crying out for. It was originally targeted at students specifically.”

At the time, Australian consumers were still enamoured with branded jewellery – the success of Pandora specifically had blazed a trail that many successfully pursued.

Duraflex Group Australia managing director Phil Edwards says that Daniel Wellington effectively ‘covered all the bases’ when it comes to commercial success.

“It was a quality product supported with strong marketing, which entered the market at the perfect time. That’s always a recipe for success,” he explains.

“At the time, the Australian market was riding the wave of many successful branded products – think of Pandora and Thomas SABO, as examples – and consumers were looking for similar products at a similar price point.”

|

|

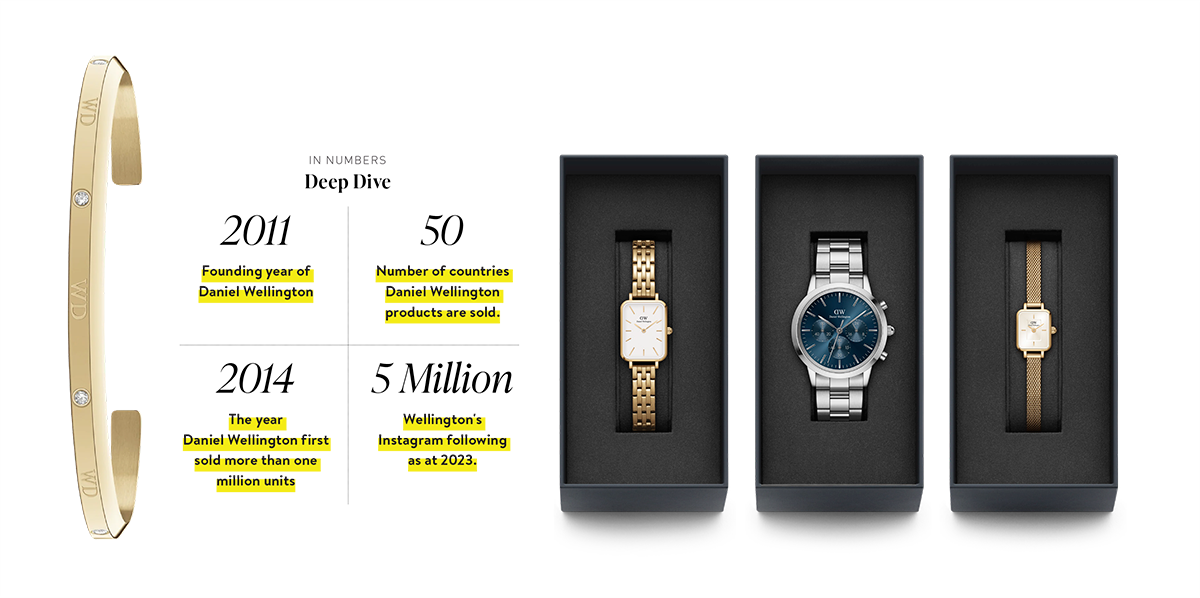

| The latest releases from Daniel Wellington. The brand has plans to expand further into jewellery in 2024. |

|

Influence

The impact of influencer marketing has played a central role in Daniel Wellington’s global fortunes.

In the brand's early days, Tysander identified an opportunity to ‘spread the good word’ about the product via social media, specifically Instagram.

While rival companies had already entered this space, he wanted to take a different approach. Rather than risk a significant investment in established celebrities and trendsetters, Tysander approached smaller influencers with a modest but impressive following.

The offer was usually the same – promote the brand on your profile in exchange for a free watch. The campaign cost was minimal – merely the cost of producing the watch, which, given the price point, was already an advantage over competitors.

Because Instagram’s timeline was chronological then, the more influencers promoting the brand, the greater the reach. Today, Instagram’s algorithm determines the order in which posts appear in a user’s feed, and influencers must identify sponsored posts.

This means that brands cannot imitate the early success of Daniel Wellington – indeed, Tysander was ahead of his time. Many successful overseas brands have eyed Australia as an obvious avenue for expansion; however, it’s a tough market to crack.

Daniel Wellington is a rare example of a brand that circumvented these challenges.

“With the influencer marketing at one end and strong partnerships with distributors worldwide at the other end, it was a perfect recipe,” Levin says.

“We experienced success in Australia almost immediately, and it all goes back to the importance of our marketing strategy and the support of a local distributor that pushed the brand hard offline.”

While marketing conditions have changed since those halcyon days, the fruits of this strategy remain plain to see. Daniel Wellington has more than five million followers on Instagram and a global reach of approximately 60 million.

The brand also continues to receive support from prominent brand ambassadors - Kendall Jenner, Hailey Bieber and Odell Beckham Jnr, to name a few.

|

|

| Daniel Wellington quadro 26mm 5-link white dial gold watch |

|

Lessons learned the hard way

In business, having a quality product in high demand with consumers is not enough.

Managing rapidly increasing demand is a hurdle many otherwise successful brands have stumbled at, and the results can be disastrous.

Daniel Wellington handled this challenge with a simple philosophy.

“Very early on, our founder established one clear rule – we are never out of stock,” he explains.

“We had a peak of close to one million products in inventory at a single time, and it was all about ensuring that our retail partners would never be short of stock.

“We enjoyed five or six years of fantastic success worldwide, and when we launched our retail expansion, we opened more than 400 stores globally.”

As the brand continued to expand, Daniel Wellington attempted to move to a vertically integrated model, pivoting away from partnerships with distributors in favour of brand-only stores.

At the same time, the COVID pandemic began. Public gathering was prohibited in markets worldwide, and the roller doors slammed shut on brick-and-mortar store sales.

West End Collection previously distributed Daniel Wellington in Australia; however, that partnership was terminated.

The New Zealand subsidiary of Daniel Wellington was liquidated in May 2020 – less than two years after it was incorporated.

Johan Liberg, global sales manager, says that revenue for Daniel Wellington declined during this period and that the pandemic handed a young brand – which had become a household name worldwide within a few short years – many lessons learned the hard way.

“We are happy to admit that our timing was wrong. Operating stores during a global pandemic quickly became an expensive proposition,” he jokes.

“We acknowledge that we underestimated the importance of having a strong partnership with a local distributor that understands the market intricately. It doesn’t matter if it’s Australia, Italy, or Sweden; you need the insight of a powerful local player.

“It was a good lesson for us to learn.”

|

|

| Daniel Wellington iconic link arctic 40mm blue dial stainless steel watch |

|

Rome wasn’t built in a day

With the challenges of the pandemic in the rearview mirror, Daniel Wellington is on a mission to steadily increase sales with the support of partnerships with distributors like DGA.

“We know that what we experienced in our early days is rare, and now it’s about becoming a consistent business that steadily increases sales,” Levin says.

With that said, Edwards says there is still a clear gap in the Australian market for Daniel Wellington products.

“After the success of the brands I mentioned earlier, there was a feeling among retailers that they had ‘overbranded’ themselves. Stores moved away from branded jewellery – they wanted their store to feel unique and represent them,” he explains.

“That means with the few brands that they do stock, they are very selective. The good news is that we are finding that retailers are very enthusiastic to have Daniel Wellington back on their shelves.”

He added: “That comes back to two factors. The product still clearly resonates with consumers, and the demand is high. There isn’t anything else in the market that meets these needs. It’s another ‘perfect recipe’ so to speak.”

Currently, Daniel Wellington is performing exceptionally well in department stores and mini-majors; however, distribution via independent retailers is limited. This will be DGA’s focus.

The partnership is also unique when it comes to e-commerce, with Daniel Wellington remaining in control of online sales.

Levin says that this is a strategy the brand employs globally.

“The idea behind that strategy is simply that we started online – our brand was constructed digitally, and so we decided to keep that online business to ourselves,” he says.

“This is not only our approach in Australia – it’s how we handle every market. Our large e-commerce staff in China and Sweden oversees our global operations.”

|

|

| Daniel Wellington quadro 6mm mini evergold champagne watch |

|

What’s next?

From the highs of rapid global popularity to the lows of the pandemic, Daniel Wellington has seen it all in a little more than a decade.

From here, the brand plans to expand further into the jewellery market.

“Our main focus for the next two years is expansion into jewellery. Based on macro trends, and examining the performance of our products, we can see that jewellery is an opportunity for expansion for us, and we want to capitalise on the opportunity,” Liberg says.

“It’s something that we’ve been working on for a long time. We launched our first line of jewellery products in 2016 to test the waters, and the results were pleasing.”

He added: “There will be many classics; however, we are adding our touch and refining necklaces, earrings, and rings to suit our identity. The plan is to offer something new to customers that already identify with our product.”

The importance of identity was something Edwards stressed repeatedly when discussing DGA’s partnership with Daniel Wellington.

“It’s a brand that never tries to be something it’s not – it has an evident ethos that it remains true to. That’s a positive; the brand's identity is strong.”

“In my time, I’ve seen many brands try to branch out into new areas, and they fail because they forget their roots. Daniel Wellington hasn’t – it’s about consistency and development.”

He added: “Brands need to stay true to themselves while finding ways to improve and offering something new. It’s a difficult balancing act.”

Australian consumer confidence remains weak, and household budgets have tightened; however, the pandemic taught us that people tend to treat themselves with luxury indulgences when times are tough.

In business, there are no secret recipes for success. With that said, whether it be with watches or jewellery, Daniel Wellington’s inclination to offer a quality product at an affordable price might just open the door for retailers to meet these new consumer demands.

READ EMAG