The UK-based retailer expects sales of between £1.53 billion ($AU2.95 billion) and £1.55 billion ($AU2.98 billion), an increase of between two and three per cent.

The retailer initially forecasted an improvement in sales of between eight and 11 per cent; however, CEO Brian Duffy said the retail environment was proving more challenging than anticipated.

"The festive period was particularly volatile this year for the luxury sector, with consumers allocating spend to other categories," he said.

“While we are disappointed with this trend, we are encouraged by our market share gains in both the US and UK.”

Watches of Switzerland also confirmed a double-digit sales increase in the US in the third quarter, which ended 28 January.

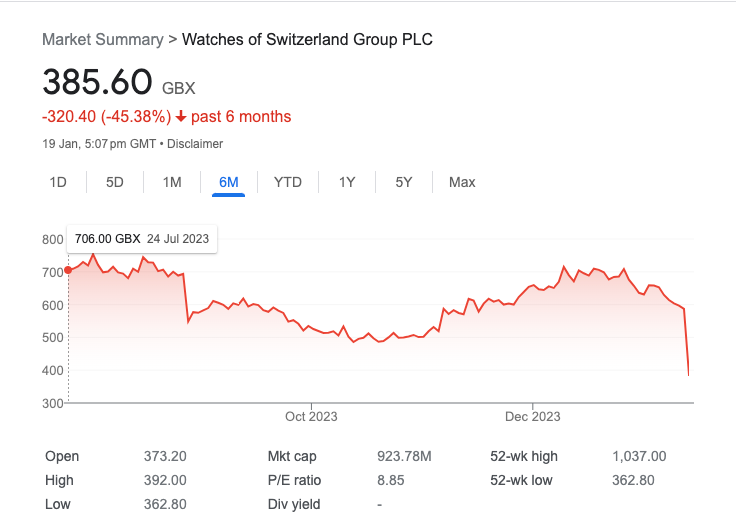

The company will release a full financial report on 8 February. The market responded quickly to the announcement, with share prices sharply decreasing.

“Watches of Switzerland slashed its annual revenue and profit margin forecast on Thursday, as consumers spend less on luxury items amid a cost-of-living squeeze, sending the luxury retailer's shares down to an over three-year low,” Reuters reports.

“Shares in the company, which sells brands including Rolex, Cartier and Patek Philippe, plunged as much as 30 per cent, its steepest one-day drop ever.”

The report continued: “Several factors ranging from geopolitical tensions, a slower-than-expected recovery in China after COVID-19 shutdowns, and raging inflation have restricted consumer spending. Luxury brands are particularly hit with a slowdown in demand as high costs make people judicious with discretionary spending.”

Watches of Switzerland operates more than 170 stores worldwide and is a major retailer of brands such as Rolex, Omega, Cartier, TAG Heuer, and Breitling.

Fluctuations in Watches of Switzerland share price over the past six months. |

More reading

Positive sales: Watches of Switerzland maintains optimistic forecast

Rolex and Bucherer: Future of luxury watch industry still uncertain

Watch industry shocked: Rolex acquires Bucherer

Supply issues prompt sales decline for Watches of Switzerland

Watches of Switzerland sets revenue record

Luxury watch market approaching $100 billion milestone