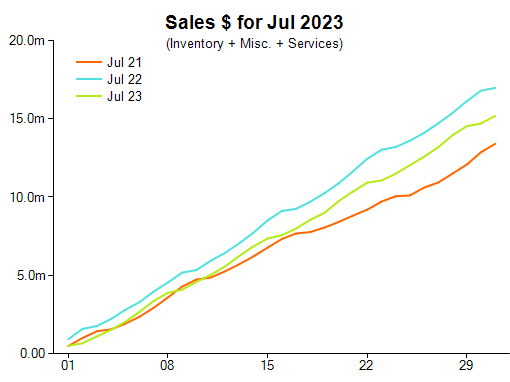

The data from July showed comparative overall sales dollar performance decreased by 11 per cent compared with a year-by-year comparison.

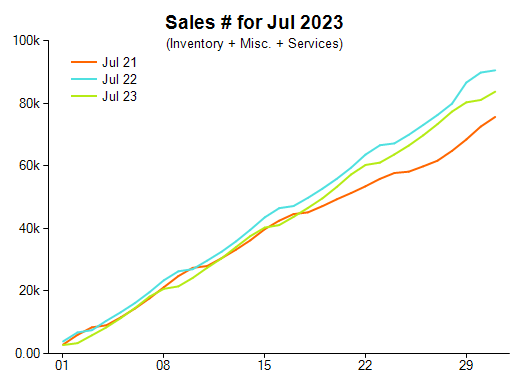

Comparative units sold decreased by eight per cent compared with 2022; however, increased by 11 per cent on a two-year difference.

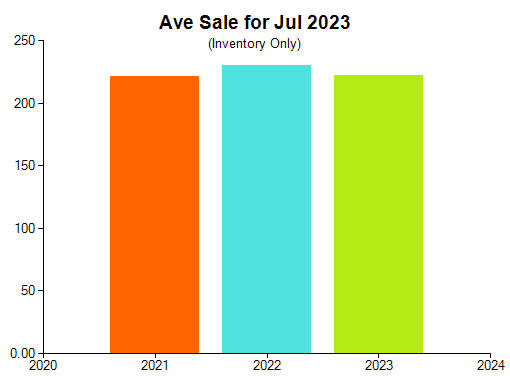

Comparative average sale – inventory only - decreased by 3.6 per cent from $230 to $222. On a two-year comparison, that category was neutral.

In terms of laybys, sales decreased 9.5 per cent in dollar terms between new orders and pick-ups and/or cancellations.

The pattern in services, including repairs, showed a decrease of 35.5 per cent in dollar values between incoming orders and pick-ups and/or cancellations.

“This is the sixth consecutive month of double-digit negative movement in this area. This is an entrenched consumer pattern that may need more than a small shift in consumer sentiment to flip the switch from off to on,” general manager Leon van Megen said.

“This is not to say you should sit back and accept what is happening. Make some noise about your services, skills and expertise. Repairs are still being done, you just may need to make an effort to get, or keep, your share and maybe someone else's.”

Special order numbers were strong, increasing by 17.5 per cent in dollar terms between new orders and pick-ups and/or cancellations.

Sales dollars for the diamond precious metal jewellery section decreased by 21 per cent compared with 2021.

Colour gemstone precious metal jewellery sales dollars decreased by 17 per cent on a year-by-year comparison; however, increased by 14 per cent compared with 2021.

Sales dollars of precious metal jewellery without a gemstone decreased by 21 per cent compared with 2022. Silver and alternative metals jewellery decreased by 7 per cent; however, increased by 23 per cent on a two-year comparison.

Consumer confidence improving

The latest ANZ and Roy Morgan Consumer Confidence research was positive, reaching its highest levels since April.

According to the report, consumer confidence has increased by eight per cent, with improvements in NSW, Victoria and South Australia noted.

Senior economist Adelaide Timbrell said the increase in confidence could be attributed to an improved outlook in terms of ‘future financial conditions.’

“Still, confidence remains low as households grapple with ongoing high inflation and restrictive interest rates, which is also reflected in falling retail sales,” he said.

Despite the increase, the index has now spent an equal record 22 consecutive weeks below 80 points – equalling the all-time record of five months from September 1990 to January 1991.

2023 Jewellery Retail Sales July Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Cause for celebration for jewellery retailers

Retail Edge urges caution in the latest market assessment

Weakened sales headlines April for jewellery retailers

Modest sales wins for Australian jewellery retailers

Optimism following February’s retail jewellery analysis

Surprise reversal pattern observed in Australian jewellery sales

Australian jewellery sales steady in December