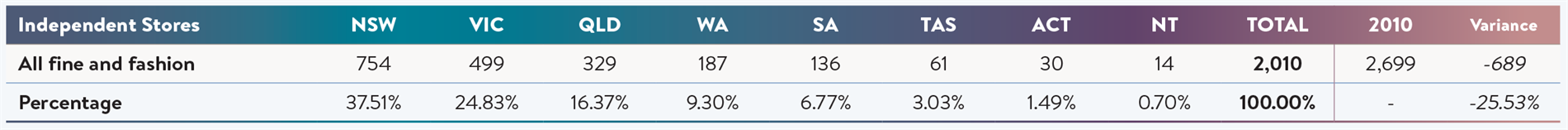

When Jeweller first conducted the State of Industry Report (SOIR) in 2010, Australia had 2,699 independent jewellery stores, consisting of retailers that sold fine and/or fashion jewellery.

There were a further 1,355 jewellery chain stores and a small number (153) of brand-only stores, meaning that around 4,223 stores were catering to a population of 19.72 million.

At the time, if you were to ask someone whether the number of independent jewellers would increase or decrease in the decade ahead, it’s fair to say that most people would have considered a decline more likely than not.

There were, and are, many reasons why such a prediction would have been reasonable, despite the fact the jewellery industry has - and continues to - sail against the winds of change that impact most other retail categories.

You only need to consider sports, chemist, and hardware stores - to name a few - where national chains and big box retailers have overrun independent and (mostly) family-run retail businesses.

It could be worse; consider operating in a category that no longer exists (video stores) or has almost disappeared (newsagents and music stores).

Given this background, it is fair to assume that a decline in the number of jewellery stores was likely - if not guaranteed - but the question is: to what extent would that store count decline?

There are many perfectly logical - and predictable - reasons for a slight decline, given that most jewellery stores were owned by an ageing population (primarily men) approaching retirement.

And gone are the days where it was a given that the children would take over the business; therefore, a percentage of store closures was predicted as ‘natural attrition’.

This is ‘the known knowns’, to use the term by the US Secretary of Defense, Donald Rumsfeld.

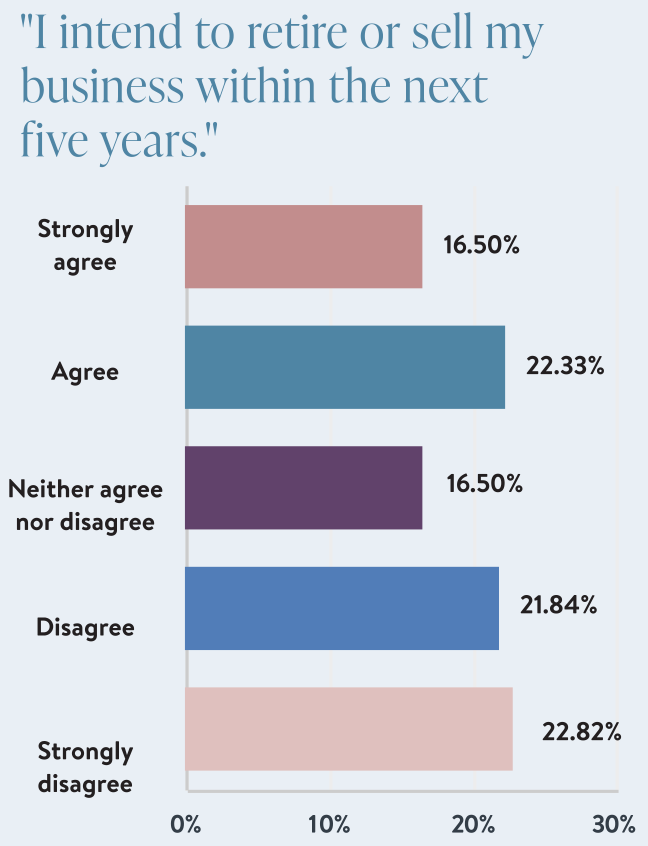

Further, as Jeweller’s recent survey of more than 200 jewellers demonstrates, retirement is still a significant issue. The accompanying chart below (Retailer - Survey Questions) indicates that 45 per cent of respondents intend to retire or sell their business in the next five years.

But as you will see, some issues would also create decline, which perhaps were not as apparent 13 years ago - but now are! They were the known unknowns.

And, of course, the elephant in the room must not be ignored – the unknown unknown!

Not for a second would anyone in 2010 have thought the world would experience a global pandemic that would create international turmoil and almost overnight destroy business activity worldwide.

So, given these factors, what would have been considered a reasonable - and natural - decline in the number of jewellery retailers since 2010, and how would that figure be reassessed given the unexpected impact of the COVID-19 pandemic?

This report cannot answer the second question; however, it’s reasonable to assume that a natural reduction in jewellery stores would have been about, or a little above, 10 per cent.

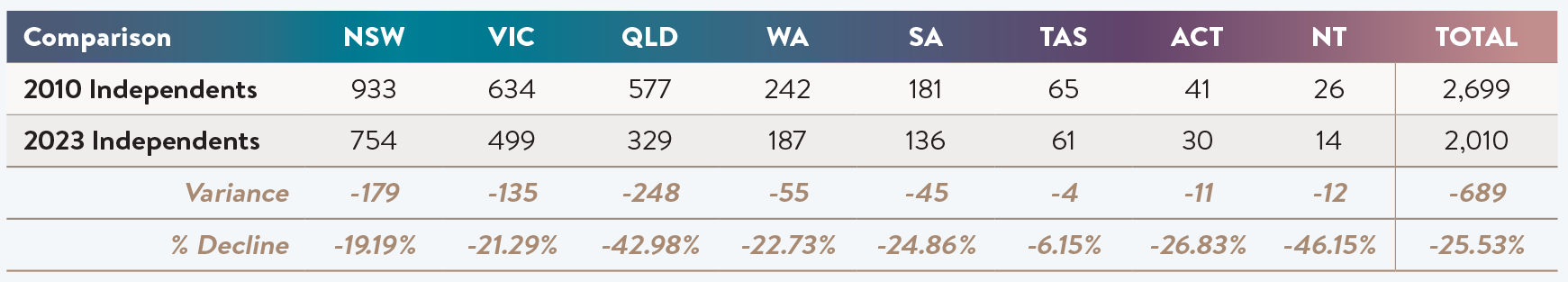

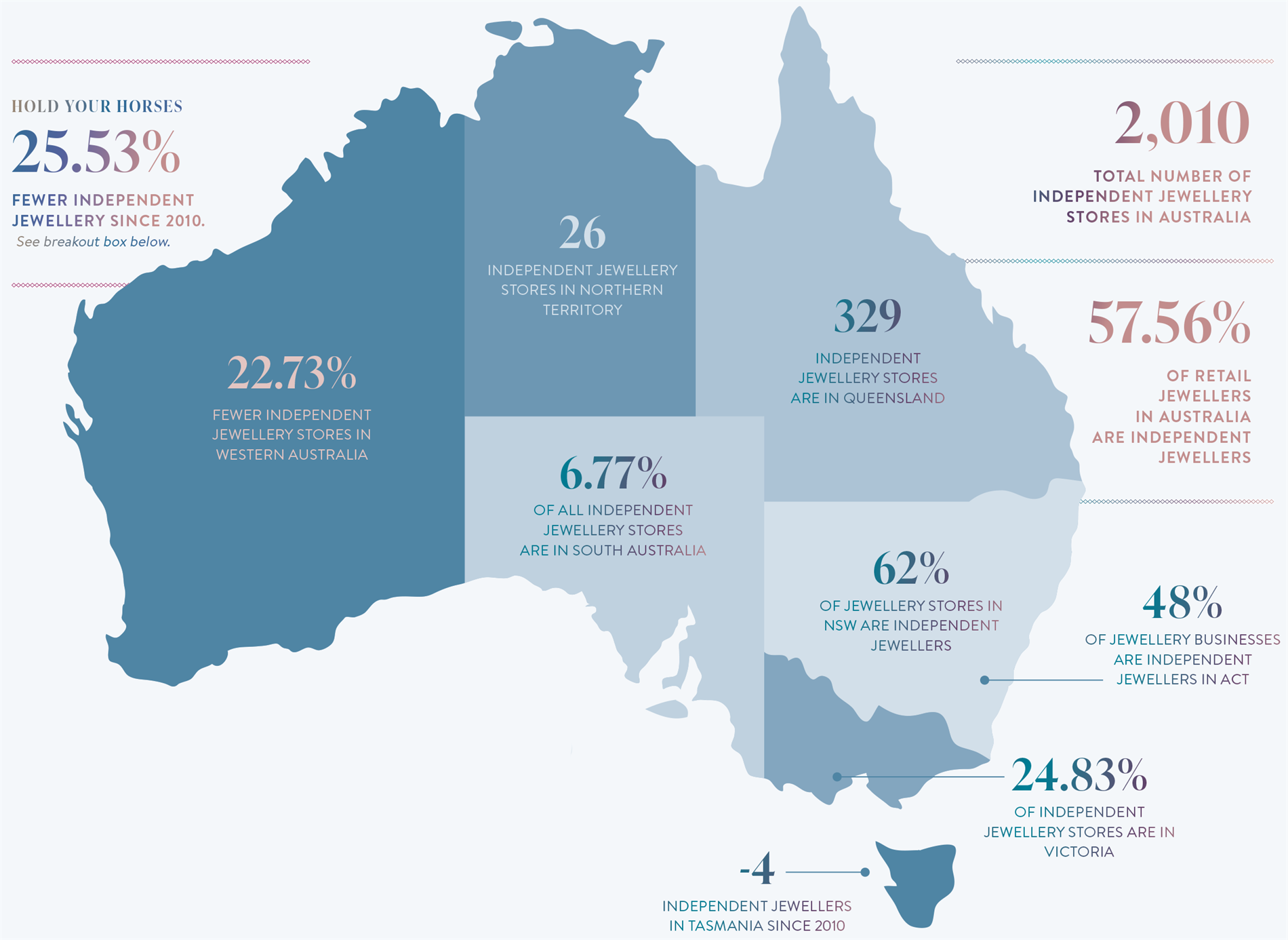

TABLE 1: INDEPENDENT JEWELLERY STORES IN AUSTRALIA 2023 |

|

| Chart shows a state-by-state store counts for independent jewellery stores in Australia, with the total figure contrasted with 2010. |

Back to the future

Before examining the results of Jeweller’s new study of the Australian jewellery industry, let's look at some of the observations made in 2010 to assess their accuracy.

For a start, it was observed that the Australian jewellery industry had demonstrated a surprising resilience in the face of the 2008-2009 global financial crisis (GFC).

|

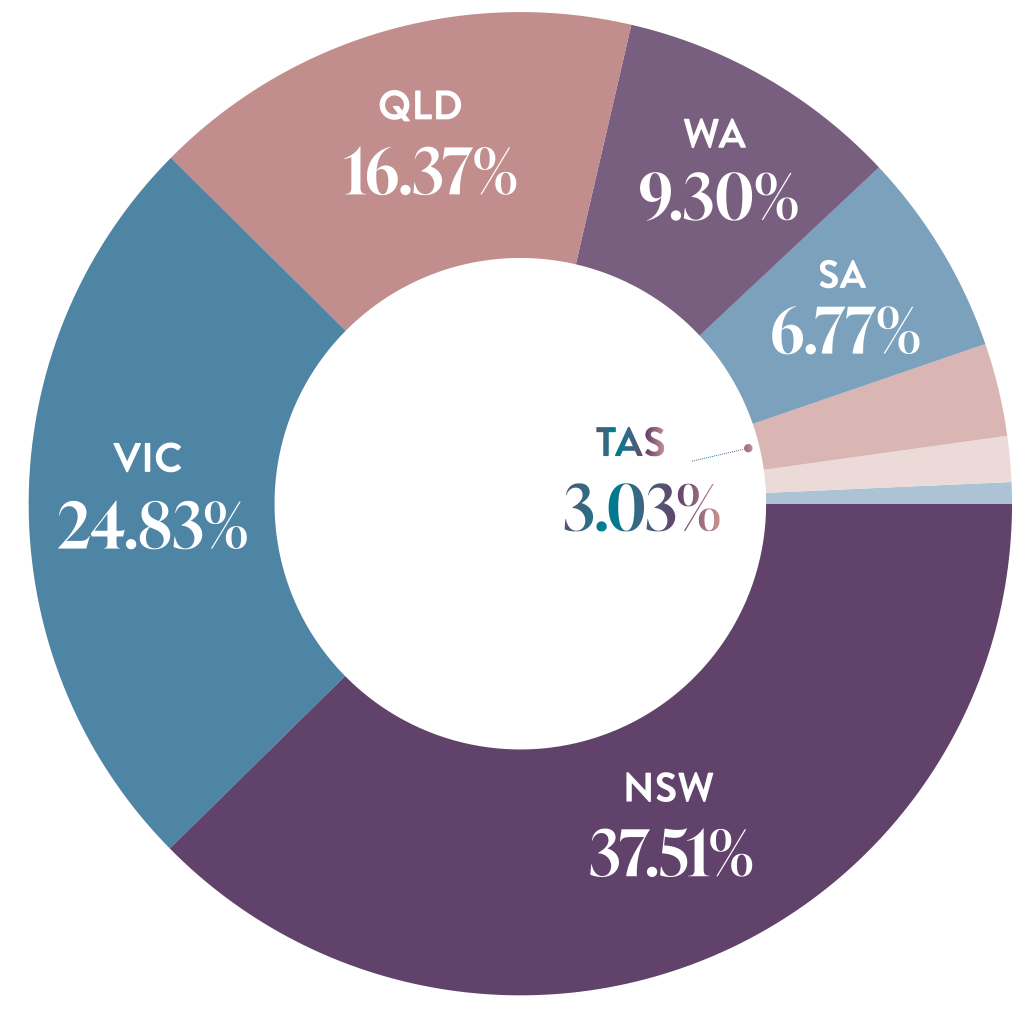

CHART 2: 2023 INDEPENDENTS BY STATE |

|

| Chart compares independent jewellery stores state-by-state and the percentage these stores represent within Australia's total count. |

While many other countries suffered an economic recession, Australia’s economy avoided it. However, the economy was impacted by high inflation - which led to repeated hikes in interest rates - consumer confidence was adversely affected, and discretionary spending took a knock.

Does that sound a little familiar today?

The 2010 report stated that, surprisingly, the country's total number of jewellery stores had remained at the 2007 pre-GFC level.

It was noted that compared with other retail sectors, such as entertainment and clothing (which compete with jewellery for the consumer’s discretionary dollar), the Australian jewellery industry has been successful at insulating itself from the increasing presence of chain stores.

This can be compared to US data showing that the GFC devastated the US jewellery industry. A census by the Jewelers Board of Trade (JBT) - a not-for-profit, member-owned association - found that “the number of jewellery doors which closed in 2008 is estimated to be around 1,500, though some believe it was closer to 2,000.”

The 2010 SOIR stressed ‘retirement’ as another common reason for independent jewellery store closures. Small, family businesses have always dominated jewellery retailing, and the post-war baby boomers had caused a spiral in store closures.

Jeweller reported 13 years ago that if no family member is willing to take over, the only other option is to close the business. Succession planning is notoriously difficult for retailers.

In addition, it’s challenging to sell a jewellery business as it is capital intensive – meaning a significant investment in stock and fit-out - and requires a higher degree of expertise than many other retail categories.

Jewellery knowledge is the most basic requirement - and gemmology, jewellery designing, and manufacturing skills are desirable.

Selling the business is always an option, but it is not easily sold if profitability is marginal. And again, this is a trend in the Western world, supported by US data.

The JBT data dates to 1987, and in 2009, it was reported that every year – except three years in the early 1990s – the number of US retail jewellery businesses had declined.

Our 2010 study also noted, anecdotally at least, that recessions and difficult trading conditions tend to separate the ‘wheat from the chaff’.

Unsuccessful small businesses will often use the excuse of a ‘recession’ to save face when they announce closure rather than taking responsibility for their business failings.

That is, it’s easy to make money in good times, and if you own a business that is only marginally profitable when difficult trading conditions arrive - as they indeed will - a borderline business will not survive.

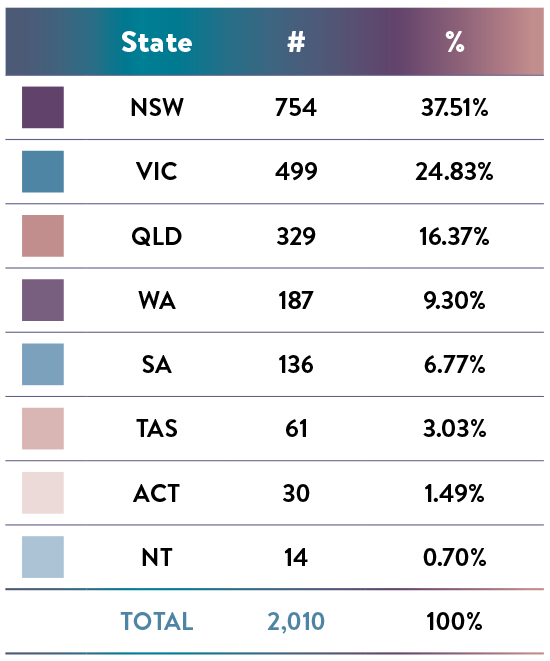

RETAILER - SURVEY QUESTION |

|  |

| Only 33 per cent of independent jewellery retailers report that their business is profitable today than it was before the pandemic. | Custom made and bespoke jewellery has become an increasingly important category for Australia's independent jewellery retailers in the past decade. |

Hold your horses

Having established several reasons why independent jewellery stores would naturally decline in number, the 2024 study finds that there are around 2,000 stores today.

This is a loss of around 700, or 25 per cent, since 2010. Now, before anyone cries wolf, hold your horses!

This reduction needs further clarification because some of it can be attributed to Jeweller’s change in the definition or classification of a ‘jewellery store’ caused by enormous structural shifts in the industry over the past decade.

The 2010 study was an attempt to measure the number of stores that sell jewellery to consumers, and in doing so, there was a need to define different business archetypes.

These included fine and fashion jewellery, chain stores, and stores classified as brand-only and/or flagship locations. To measure anything, it must first be defined.

In 2010, the definition of a jewellery retailer included businesses that were not ‘traditional stores’. For example, our data included jewellers and designers who operated from what we defined as ‘upstairs premises’ or studios and workshops.

Many, if not most, of these businesses legitimately deal with the public as customers and specialise in niche categories such as engagement, bridal jewellery, and bespoke design.

Most operated from CBD locations in capital cities and were (and still are) located in the ‘jewellery buildings’ such as the Century and Manchester buildings in Melbourne and the Dymocks and Trust buildings in Sydney, to name just a few.

Other capital cities have similar buildings, harking back to a period when jewellers and suppliers congregated in one location for convenience and security. A jeweller could source and purchase materials, such as diamonds and gemstones, by visiting a supplier on another floor – without the need to leave the building.

These businesses were identified as ‘Retailer - No storefront’ and included in the store counts.

TABLE 3: 2023 - 2010 COMPARISON |

|

| Table 3 compares independent jewellery store counts from 2010 to 2023. Overall, stores have declined by 25.53 per cent; however, this is easily explained. |

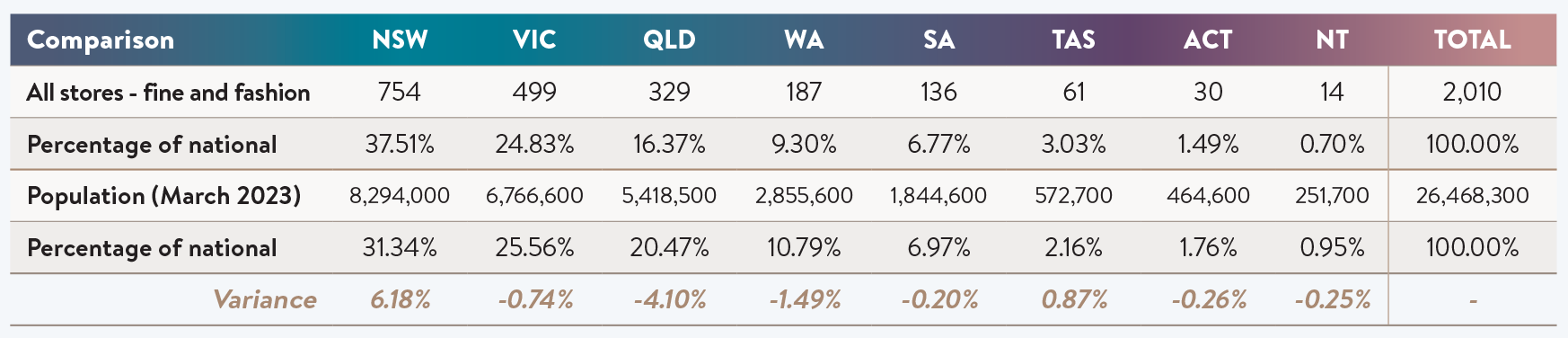

TABLE 4: 2023 POPULATION COMPARISON |

|

| Table 4 takes the 2023 store counts and shows it as a percentage of the overall total, for example, NSW has 37.1 per cent of the national store count. The population of NSW is 31.34 per cent of Australia’s total population which means its store count has a six per cent variance to the population. |

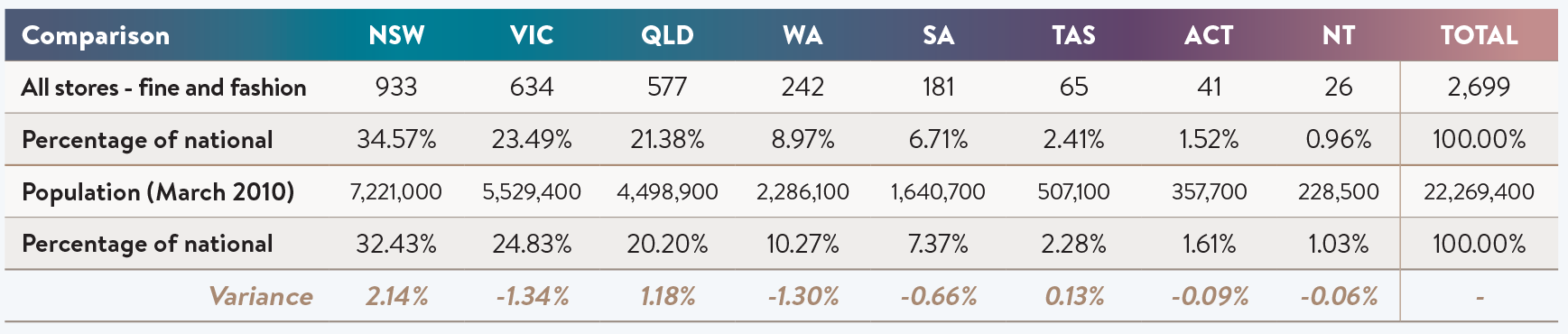

TABLE 5: 2010 POPULATION COMPARISON |

|

| Table 5 presents the same data as Table 4 except that its 2010 data, which means the 2023 store count and population percentages can be compared to the the data from 13 years ago. *Census March 2023. |

Changing times

While it was deemed appropriate to include these businesses in the 2010 store counts, Jeweller has decided to exclude them in the latest study due to changes in the industry, some of which are COVID-related.

For example, consider the distinction between a ‘storefront retailer’ on the high street and one that operated without a storefront was a little blurred in 2010. In that case, you must consider what the internet has done to that blurred line 13 years later.

There are other reasons for redefining a jewellery store - explained below - and to maintain a more accurate reading on the industry, it is more appropriate to measure ‘traditional retail stores’, which Jeweller now defines in accordance with government descriptions and legislation, such as Retail Lease Acts.

|

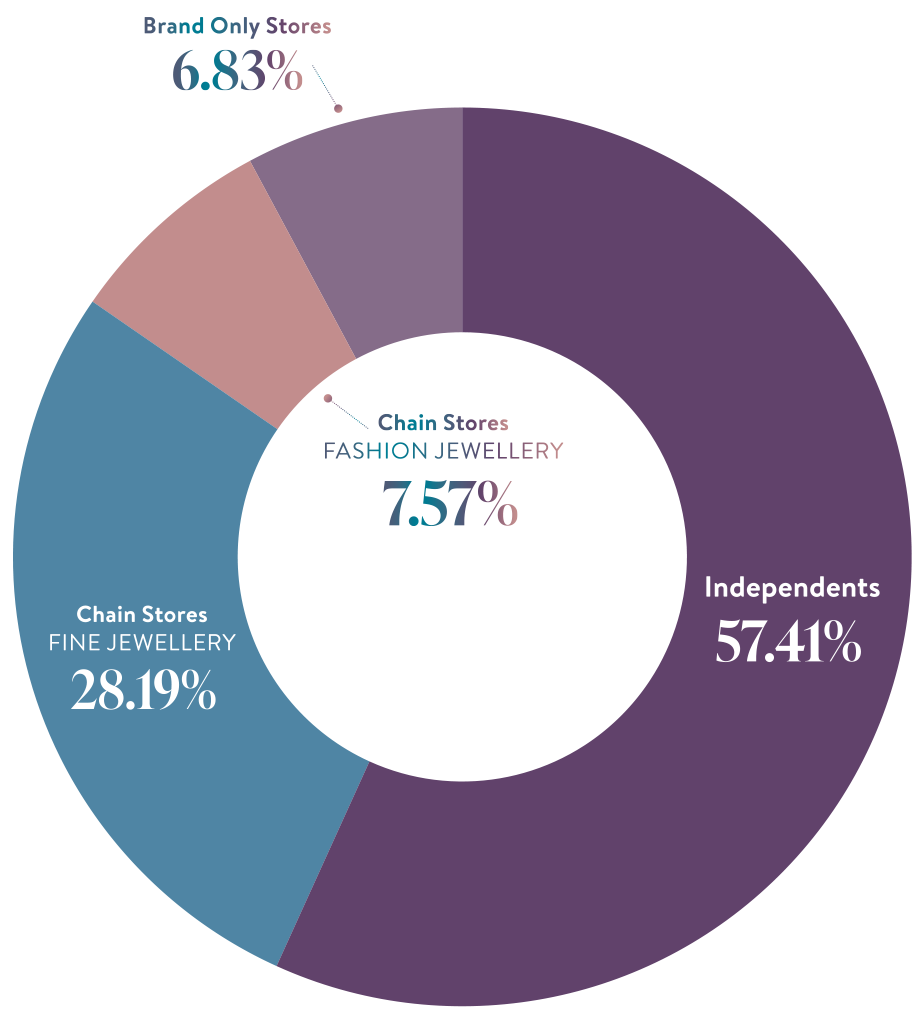

CHART 6: 2023 NATIONAL STORE COUNT - ALL CATEGORIES |

|

| Chart shows Australia's total fine and fashion jewellery store count divided into four key categories. In 2010, independent jewellers represented 64 per cent of the market compared to 57 per cent today. |

A ‘retail premises’ is, therefore, a place, not including any area intended for use as a residence, that under the terms of the lease is used, or is to be used, wholly or predominantly for the sale or hire of goods by retail or the retail provision of services.

Given that the nature of retail business has dramatically changed over the past decade - and some of the change was brought on by COVID - for the sake of an industry study, a jewellery retailer is now defined as a retail premise used wholly or predominantly for the sale of jewellery (fine and/or fashion) and watches to consumers.

The business must be readily available to visit by the public during business hours (no appointment is necessary) and must carry stock readily available for purchase when a customer visits; that is, the item does not subsequently need to be made/manufactured.

In other words, a jewellery store is located on a high street or in a shopping centre/mall (small and large) where consumers shop for something ‘off-the-shelf’. This could include shopping for bespoke and custom-made jewellery items.

With that said, online retailers, jewellery studios and workshops, ‘by appointment’ designers and jewellers are no longer considered jewellery stores. Further, a new post-COVID retail trend - unstaffed or virtual showrooms - are also excluded.

While there will always be shades of grey in any group of definitions, it is important to redefine the trade’s participants in line with the industry’s evolution.

For this reason, some of the decline can be attributed to this reclassification and is not a reflection of store closure.

Jeweller estimates that within the 689-store reduction since 2010, this reclassification accounts for between 100 and 150 businesses.

This study has discovered that the way many jewellers survived the COVID pandemic was to change their business model, which included scaling back their business. In some cases, the business arguably could not be considered a ‘store.’

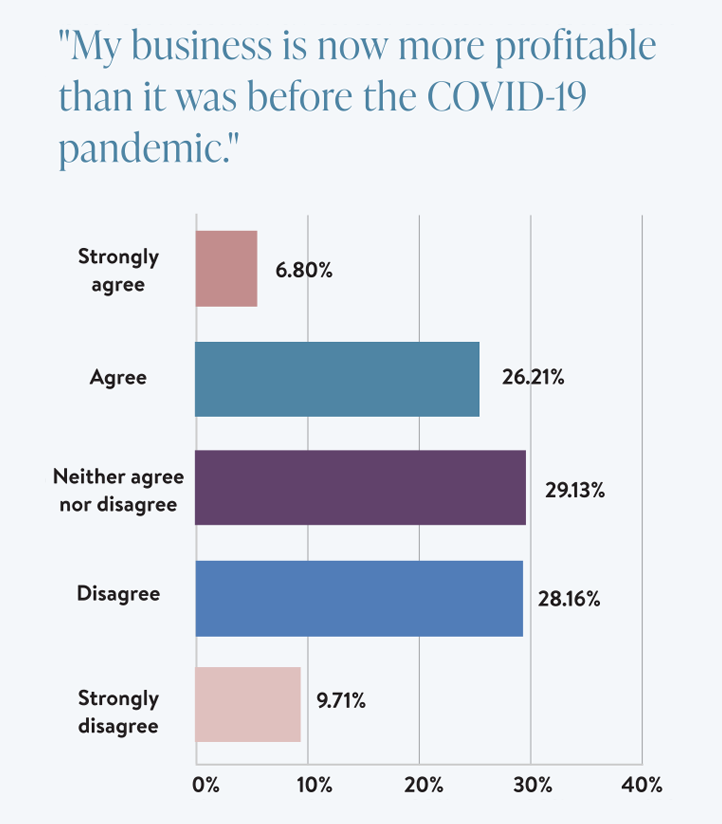

Show me the money!

One of the more surprising results of the retailer survey was the number of businesses that are now more profitable following the global pandemic.

When asked if their business is more profitable after COVID, 33 per cent of jewellers ‘strongly agreed’ or ‘agreed’.

Interestingly, the number of jewellers who ‘strongly disagreed’ or ‘disagreed’ only amounted to 38 per cent.

This somewhat counterintuitive result can be attributed to storeowners taking actions to change the management and procedures of the business to increase profitability or, in many cases, survive,

Some of this can also be attributed to consumer demand for custom-designed and manufactured jewellery, which has resulted in many changes to the industry.

For example, it’s generally considered that few jewellery stores carry as many diamonds or diamond jewellery in stock as they once did and needed to, compared to a decade ago.

Also, many customers will inspect a ring in stock and request a change.

This means a significant focus must be stock management – ensuring that sales are not lost, and excess/old stock is minimised.

It is also arguable that increased profitability could be explained by decreased competition.

For example, if a jeweller had a nearby - and less successful - competitor before COVID, such a rival would most likely compete on price.

Negative economic tides, such as recession and unanticipated pandemics, will quickly knock out any marginal businesses, which means the remaining stores service a larger consumer base and market share.

Indeed, recessions can be an ‘every cloud has a silver lining’ phenomenon for some, where there is more business for fewer stores when the economy recovers.

And given that the reduction in store counts can be attributed to at least two reasons - natural declines such as lease expiration and retirement and forced decline from COVID and other adverse economic conditions - if consumer spending remains constant, more revenue will be divided among fewer stores.

The ‘unknown unknown’

Undoubtedly, many jewellery store closures since 2020 were because of COVID. No different to all small businesses - especially retailers - jewellers could not survive the turmoil created by the pandemic.

RETAILER - SURVEY QUESTION |

|

| Survey data suggests that the 'changing of the guard' within the jewellery industry will continue for the remainder of the decade due to retirements. |

They shuttered their stores, never to return. Arguably, this was done in many categories by retailers whose business profitability was marginal.

There is also anecdotal evidence to suggest that many high street stores - including jewellers - took advantage of COVID to exit a lease that they would otherwise not have been able to do.

With government legislation enacted to ‘protect’ retailers from landlords during the pandemic – for example, The National Cabinet Mandatory Code of Conduct – SME Commercial Leasing Principles - it was unlikely that any landlord would take legal action for breaking a lease during COVID.

Put another way, a marginally profitable retailer with two to three years reamining on a lease saw COVID as a legitimate excuse to close the business without possible legal ramifications.

Most retail leases are three to five years, so any signed in 2018 or later would have been due for renewal in 2023-2024.

Many businesses struggled to survive throughout COVID; some were ‘stressed’ before the pandemic and therefore closed before the lease expired.

This was different for retailers in shopping centres, where the landlords were seen to be more ruthless.

A figure that stands out is the number of ‘lost’ jewellery stores in Queensland - 248. It is reasonable to assume that a large number of these were stores catering for the tourist market, especially along the coastline. This market completely collapsed during COVID; they were business that almost exclusively relied on incoming tourists.

Therefore, while we cannot provide an exact figure on the number of jewellery businesses closed during COVID, there is sufficient evidence to show that many jewellers moved online to become ‘no storefront’ businesses.

Jeweller can track a business that previously operated as a store and now operates online or as a no-storefront business. This became a trend because of, and enhanced by, COVID.

While they can be seen as legitimate businesses selling jewellery to consumers, the business model differs significantly from before the pandemic.

2024 STATE OF THE INDUSTRY REPORT - INDEPENDENT JEWELLERS |

|

Other changes

There have been many other changes since 2010 that are worth acknowledging. Fitting into the ‘known knowns’ category is the changing nature of retailing as influenced by Australia’s evolving demographics.

The previous report recognised that “coupled with an increasing need to cater to the consumer tastes of growing immigrant communities, new, ethnic-targeted stores have replaced old stores that have closed.”

This trend continues today, and one only needs to consider suburbs in major capital cities to see the increase in jewellery stores catering to Asian, mainly Chinese, communities as well as Indian and Middle Eastern communities. Today, we can add African jewellery stores to that list.

Another self-evident change has been the massive increase in online jewellery businesses. Jeweller’s research can identify various online operations that have different foundations.

Independent stores survive and thrive There was once a time when independent jewellers believed that ‘cheap Asian imports’ were destroying the market. Then there was a time that jewellers believed chains stores were taking over the industry. This prompted Jeweller to investigate the claim - and which initiated the beginnings of the State of the Industry Report. The two claims were proven wrong and, today, while the percentage of independent stores has fallen from 64 per cent in 2010 to 57.4 per cent in 2023, part of this decline can be explained by the redefinition of a ‘jewellery store’. |

People launching online jewellery businesses would have been a ‘known known’; however, traditional jewellers closing their physical store to move online during and post-COVID would have been ‘unknown unknown’.

The research also identified many online businesses launched during COVID for various reasons, including some who admit that it was done because of the loss of employment and/or boredom.

These fit within the hobbyist category, attempting to turn a personal interest into a business - perhaps a ‘known unknown’.

Consider factors such as the global pandemic and improved and less cost-intensive technology – including website development, e-commerce platforms, and teleconferences.

This environment has enabled many sole trader-type operations where a manufacturing jeweller works from a studio/workshop or a home-based office to produce custom-made jewellery.

This trend relates to, and is also influenced by, other trends identified in this research.

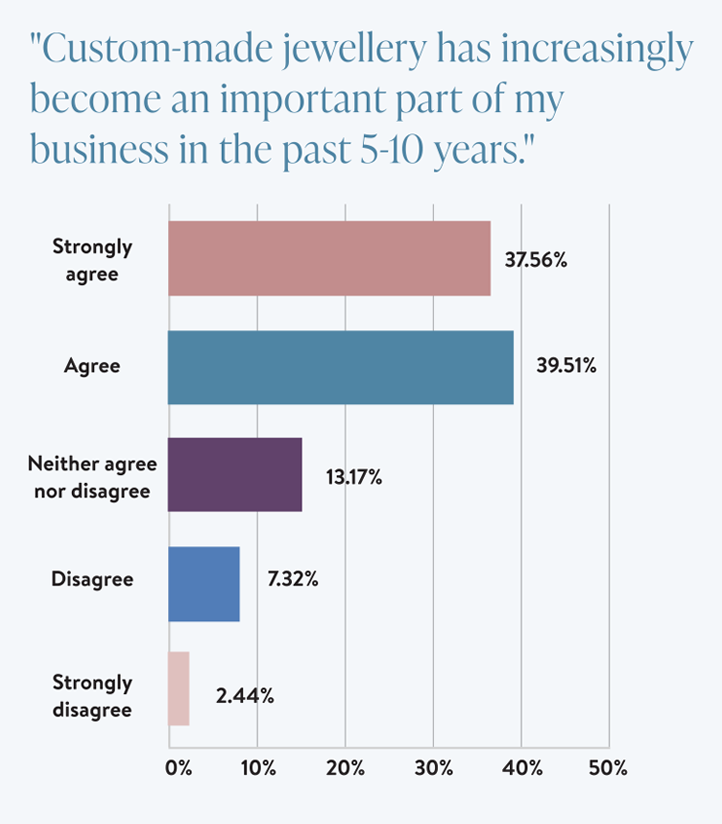

For example, the retailer survey confirmed the resurgence of bespoke and custom-made jewellery, as consumers - mainly women - search for a more personalised approach to their adornment.

A whopping 77 per cent of responses to the retail survey said they ‘strongly agreed’ (37.56 per cent) or ‘agreed’ (39.5 per cent) that custom-made jewellery has become an important part of their business in the past decade.

The bespoke trend and income from watch and jewellery repairs have had a larger flow-on effect. Shopping centre locations have become of decreasing importance for those who can offer traditional manufacturing or ‘bench jewellery’ services.

As independent jewellery stores have exited shopping centres - primarily driven out by increasing tenancy costs - and as consumers seek something different and more personal, there is less need for stores to be located in the larger shopping centres because the customer is happy to work with ‘destination’ jewellers when seeking jewellery of a more personal, and ‘everlasting’, design.

IMPORTANT CLARIFICATION

Hold your horses! While a decline of around 700 independent jewellery stores in the past 13 years might sound alarming, it's a figure that is easily explained. Firstly, as this article has noted, the definition of a ‘jewellery store’ has been changed since 2010, therefore many businesses have been reclassified and that has led to a reduction of approximately 150-200 stores. The more realistic decrease is a ‘net reduction’ of around 500 stores. With factors such as retirements and the impact of the pandemic on marginally profitable businesses, this was to be expected. Furthermore, it is important to note Jeweller has tracked around 1,000 store closures in the past 13 years. This means that while many stores have closed since the 2010 report, new stores have opened - suggesting that the jewellery industry is still an environment where new businesses are able to launch. This differs from other comparable industries (video, sports, music, and hardware stores) where declining store count is not countered by new openings. It is interesting to note that many new jewellery stores are based on ethnic grounds, that is catering to immigrant markets such as Chinese, Indian and African. |

The jewellery chains primarily cater to the mass market.

This delineation caused by consumers’ renewed desire for custom-made pieces seems to have also generated another significant change to the traditional ways jewellery is sold.

Worthy of additional research is the trend for younger designers and bench jewellers to ‘go it alone’ by establishing a small-scale business primarily based online.

They cannot or should not be considered online retailers, given that that term would suggest stock levels and consumers ordering jewellery off-the-shelf, albeit from a warehouse-style ‘shelf’ rather than an in-store showcase.

It should come as no surprise - and would be a known known - that younger and more tech-savvy people are starting their own business which is promoted in the digital world via various social media platforms.

Again, jewellery can be unique because the sparkle and luxury of the items are ideal for website, Instagram, Twitter/X and Facebook marketing.

Indeed, short videos of pieces being handmade are ideal for TikTok and YouTube.

This is not a new trend; it’s a return to the original business model where artisans handcrafted jewellery in small workshops.

Known knowings and the future

The first and only in-depth study of the Australian jewellery industry in 2010 accurately predicted many trade changes in the past decade.

Other changes caused by the unexpected turmoil created by the global pandemic could not be forecast by their very nature.

The most obvious is an increased reduction in independent jewellery stores over and above any natural decline.

Like all change, the result can be seen as beneficial or detrimental. For example, one person’s perception - or misery - is based on their outcome, say, upon losing their job due to the pandemic.

Having found themselves unemployed, a young jeweller who took a gamble by establishing their own business - and who goes on to be very successful - will have one view while the store owner approaching retirement who had to close their business as a result of the pandemic - rather than selling it - will have a different perspective.

As always, and just like jewellery, beauty is in the eye of the beholder.

Satellite showroom showoffs A new term has gained prominence in the industry: ‘showroom’. It is increasingly used by what Jeweller previously defined as ‘retailer-no storefront’. These showroom operations are where customers must make an appointment to visit the business. A showroom has traditionally been used to describe a transaction where a customer views products and orders the items to be delivered or collected at another time. It is also typically used in business-to-business transactions rather than consumer retailing. That is, a showroom does not normally entail a business carrying stock that a consumer purchases off the shelf. Since 2010, Jeweller has witnessed a shift towards this model used by various jewellery businesses, which probably gained momentum because of COVID. However, this causes a problem for an industry study. These ‘showrooms’ aim to grab a slice of the rapidly increasing demand for custom-made designs without enduring the costs associated with a retail lease, the expense of displaying jewellery, or the need to hire staff. This showroom concept also added to the reasons for reclassifying the definition of a ‘jewellery store’. It should be noted that showrooms generally do not carry stock readily available to be purchased by the public and are not the sole reason for the reclassification. There is another, more important reason behind the decision. The research uncovered a new trend by some of these ‘showroom stores’ to advertise and promote the business in a misleading or deceptive manner. In the past few years, Jeweller has observed many examples of a new business being established - or moving to - a no-storefront operation and promoting itself as having showrooms in all, or many other, Australian capital cities. The problem is that in many cases, these showrooms don’t ‘exist’; they are either virtual offices with no staff, operating from a serviced office arrangement, or, in some cases, images of a physical showroom that appear on the company’s website and, again, have no staff. For example, a jeweller specialising in engagement rings will promote itself as being based in Sydney or Melbourne and claim to have showrooms in other capital cities, such as Adelaide. The business often lists the phone number of its head office or may have a local phone number, which is redirected, unbeknownst to the customer, who thinks they are dealing with Adelaide staff. These businesses will offer a virtual appointment with their ‘highly specialised jewellers’ in the head office. In other words, the ‘interstate showroom’ is nothing but a facade. The trend is more evident post-COVID because technology has dramatically improved in the past few years, and consumers have become accustomed to not visiting stores. Indeed, many are more willing to ‘go shopping’ via Zoom meetings. These two trends were not evident in 2010, so the notion that small jewellers could have a ‘store’ in every capital city was unheard of. And it would have been unprofitable! Indeed, the advent of unstaffed ‘satellite’ jewellery showrooms was hastened by COVID. With CBD rents crashing during COVID – and some have suggested they will not recover to pre-COVID levels - the cost of establishing the ‘appearance’ of a jewellery showroom in other capital cities has become less expensive. This facade is ideal for jewellery as it is a high-margin product, at least when compared to other retail categories. That is, the additional monthly cost for renting a small interstate office, either as a physical location or a serviced office - and in some cases deceptively presented on a website - could be far outweighed by selling one diamond ring. This causes a dilemma for such a study as this State of the Industry Report, which attempts to measure the number of jewellery stores in Australia. Yes, a consumer might contact a jewellery business operating from a ‘showroom’ in Adelaide; however, the sale occurs at a ‘no storefront’ office in Sydney. Should the Adelaide ‘showroom’ be considered a jewellery store? We think not. Worse, as mentioned, in some cases, the showroom doesn’t even exist; it can be a phone call being redirected from a serviced office to another city location. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES