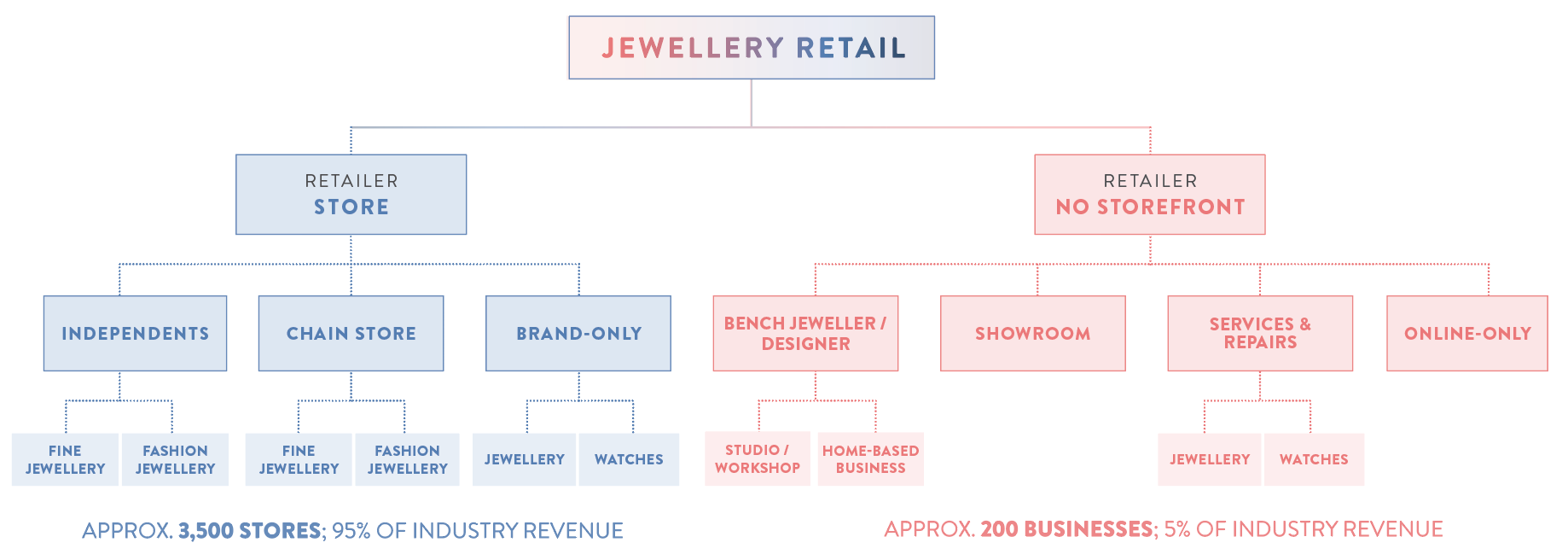

One of the most valuable components of the 2024 State of The Industry Report (SOIR) is the introduction of clear distinctions for the industry’s many evolving sectors.

When the first SOIR was published in 2010, it attempted to count the number of retail jewellery stores in Australia. To complete this task, definitions were required.

In 2010, the definition of a jewellery retailer included businesses that were not ‘traditional’ stores. For example, the data included jewellers and designers who operated from what was defined as ‘upstairs premises’ or studios and workshops at the time.

These businesses were colloquially referred to as ‘upstairs jewellers’. While these businesses were open to the public, they typically did not carry stock.

They are more service based, usually offering customers a bespoke design and manufacture of custom-made jewellery service.

This term also encompassed jewellery and watch repair businesses.

In the 13 years since that report, the industry has evolved significantly. This evolution can largely be attributed to two key events: the rise of social media and the COVID-19 pandemic.

Understanding these various businesses and their differing characteristics and attributes is crucial when completing an industry study of this nature.

The 2024 report refined various definitions to keep up with industry changes and record a more accurate reading of the current retail landscape.

For that reason, the definition of a ‘jewellery store’ now better matches government descriptions and legislation and is as follows:

A jewellery store is a physical retail premises. This does not include any area intended for use as a residence. These stores are usually located on a high street or shopping centre. Under the terms of the lease, they are used wholly or predominantly for the sale of jewellery and watches to consumers.

The business must be readily available for the public to visit during business hours. No appointment is necessary. The business must carry stock readily available for purchase when a customer visits; that is, the item does not subsequently need to be made/ manufactured.

As an unintended consequence, this change in definition contributed to the documented overall decline in independent jewellery stores between 2010 and 2024.

That is, many businesses considered independent jewellery retailers in the 2010 report were no longer regarded as ’stores’ in 2024, regardless of whether or not the business is still trading.

These businesses – between 150-200 - have been redefined as ‘Retailer – No Storefront’ (see below).

The latest report found that between 2010 and 2023, there was a decline of around 700 independent stores - about 25 percent of the market; however, this includes the redefined businesses.

Jeweller estimates that this change in definition contributed to the ‘loss’ of between 150 and 200 businesses from the overall count.

Retailer - No Storefront

Retailers operating without a traditional storefront remain an important part of the Australian jewellery industry and, as mentioned, have been labelled ‘Retailer – No Storefront’.

They are defined as follows:

A business that sells jewellery and/or watches to consumers and does not operate from a jewellery store. These include jewellery designers and manufacturing (bench) jewellers operating from professional workshops or studios.

They are often located in CBD buildings, which can be visited by the public, typically by appointment. They may also operate out of residential premises.

Normally, these businesses do not carry stock and often deal in niche markets and custom- made products.

It seems simple enough, right? Well, there’s an issue with this definition. It’s what’s known as a ‘negation’ or an ‘apophasis’—language that defines the object by what it is not rather than by what it is.

So, what is a Retailer – No Storefront? For this report, Jeweller has divided the category into five different categories.

Some of these categories have overlapping characteristics; however, the only thing that unites all five is that they are jewellery businesses that operate without a traditional store.

• Studio/Workshop - Bench Jewellers and Designers

These businesses sell jewellery and/or watches to consumers and operate from a (leased/rented) studio or workshop space.

Typically, these businesses do not carry stock and often deal in niche markets and custom- made products.

In major metropolitan areas, these jewellers are often located in CBD buildings, which can be visited by the public; however, these visits may require an appointment in advance.

Examples would be the many jewellers operating from the Century and Manchester buildings in Melbourne and the Dymocks and Trust buildings in Sydney.

There are also studio and workshop jewellers that operate outside of the capital city CBD areas, particularly in Queensland.

The key point to be understood is that these are commercial premises.

Whether the space is considered a ‘workshop’ or a ‘studio’ depends entirely on how the jeweller views or markets their business.

While a workshop implies a focus on practical and technical knowledge and work, a studio is usually associated with design and artistic exploration while creating original works.

In practice, they mean the same thing. One person’s workshop is another’s studio!

|

| CHART A - REDEFINING THE CATEGORIES: Unlike the 2010 State of the Industry Report (SOIR), the 2024 report excluded a number of retail jewellery businesses from the 'store count'. This exacerbated the decline in store numbers to 24 per cent. While manufacturing (bench) jewellers and designers dealing with the public (consumers) - as well as watch and jewellery repair businesses - have always existed, this side of the industry has greatly evolved. This is in large part due to the COVID-19 pandemic, which called for a redefinition of a number of retail categories. Only the first three blue categories are now defined as retail jewellery stores for the purpose of the SOIR: A jewellery store is a physical retail premises usually located on a high street or in a shopping centre. It is worth noting that the three categories shown in blue include more than 3,500 stores and are estimated to account for around 95 per cent of all industry revenue. The remaining four orange categories account for between 150-200 businesses nationally, and while an integral part of the industry, revenue is comparatively less significant. |

|

• Home-Based Bench Jewellers and Designers

These businesses sell jewellery and/or watches to consumers and operate from a residential property.

The business owner may consider this workspace a ‘studio’ or ‘workshop’; however, the critical distinction is that one jeweller is based on commercial premises and the other residential.

Therefore, a consumer (member of the public) will have a different mindset when visiting a jeweller’s home than when visiting a jeweller’s workshop or studio in the city.

With that said, this category of retail business shares many characteristics with the first, namely that they do not carry stock and tend to deal in niche markets and custom-made products.

• Showroom Jewellers (By Appointment)

Over the past decade, the term ‘showroom’ has gained prominence in the industry.

Showrooms are usually located in CBD locations; however, they typically do not have an onsite studio or workshop or employ manufacturing bench jewellers. Showrooms specialise in sales and typically only employ sales staff.

Any manufacturing work will be done off-site, often by ‘contracted’ bench jewellers.

Traditionally, the term showroom has been used to describe a transaction in which a customer views products and orders the items to be delivered or collected later.

It is also typically used in business-to-business transactions rather than consumer retailing.

That is, a showroom does not typically entail a business carrying stock that a consumer purchases directly off the shelf.

Showrooms can also operate virtually under a serviced office arrangement, without staff or stock.

• Jewellery/Watch Repairs and Services

These businesses offer services focused almost exclusively on repairs and remodelling. They operate from either residential or commercial premises.

While many jewellers—both with and without stores— offer services such as repairs and remodelling as part of their overall business model, a select few focus exclusively on these offerings.

That said, these jewellers have little, if any, new jewellery or watch products directly for sale to consumers — the business is predominantly focused on technical labour.

• Online Retailers

These businesses promote and sell jewellery and/or watches to consumers via a website or third-party platforms such as Facebook, Instagram, Etsy, and other social media channels.

Online retailers tend to trade exclusively in finished jewellery and typically do not employ a manufacturing bench jeweller.

It could be argued that they have more in common with suppliers than independent jewellery retailers in that they are likely to operate from a warehouse or office.

What’s changed?

While no storefront jewellery business is not a new phenomenon, the COVID-19 pandemic motivated and hastened significant change.

These changes are heavily reflected in the evolution of the Retailer – No Storefront category.

During the pandemic, there was an increased commitment to digital marketing, with social media platforms utilised to reach customers locked in their homes.

Embracing change was also particularly enticing for jewellery businesses that were only marginally profitable before the pandemic.

Anecdotal evidence suggests that many high-street jewellers used the pandemic to exit unattractive leasing agreements.

At the time, this ‘scaling down’ of the business was a necessity due to the trading conditions of the pandemic; however, for jewellers who achieved success under this new model, they soon had an important question to answer. Should they reopen their store?

That is to say, if your business struggled before the pandemic and then discovered success with a new lower-cost model during lockdowns, would you bother to return to a bricks-and-mortar store, just because the pandemic is over?

The answer is probably not!

A new generation

These same conditions also encouraged the birth of many new jewellery businesses that did not exist before the pandemic yet operate under the same Retailer – No Storefront model.

In some cases, the pandemic allowed those passionate about jewellery - who otherwise worked in other fields full-time - to launch a new business for the first time.

There are many examples of this; however, they usually follow a similar formula. Someone interested in jewellery manufacturing finds themselves out of work due to the pandemic.

During that time, they focused on creating jewellery, launched social media accounts to market their creations, and then joined an e-commerce platform to finalise sales.

As sales continued to roll on after the end of the pandemic, the jewellery business continued— sometimes with the inclusion of a physical store, but not often. If it ain’t broke, don’t fix it!

There is also anecdotal evidence to suggest that many of these new businesses that opened in the past few years came about after manufacturing (bench) jewellers chose to ‘go it alone’.

In some cases, this could also be attributed to the pandemic. These jewellers may have already been employed by a store that closed due to the pandemic.

These jewellers then decided to continue earning a living using their designing and manufacturing skills — this time as sole traders rather than as employees.

Younger tradespeople, more attuned to social media strategy and marketing, took their skills and started sole trader businesses, creating attractive websites to promote their skills and expertise.

The decline in costs associated with the digital tools and services required to run a business, such as payment gateways and accounting programs, reduces the risks associated with running your own business.

The same could be said for access to industry-specific technology, such as CAD/CAM. Decreased cost and increased availability mean less risk for sole traders.

Given the trends towards custom-made and bespoke jewellery, this became an even more attractive prospect.

No longer is there a need to be located in high-traffic shopping centres or suburban high streets if you operate a destination business — one that customers will happily travel to.

For those who performed well during the pandemic and remained successful after its conclusion, there was no need to return to a traditional retail store.

Satellite showrooms

While the market always determines how an industry evolves – as, they say, necessity is the mother of invention – it’s fair to say that not all change has been positive.

Jeweller noticed an increasing trend during the six-month research phase of this report, which was labelled ‘satellite showrooms’.

As detailed above, the showroom-style jewellery business existed before the pandemic, and there’s nothing ‘wrong’ with this approach to doing business.

With that said, the pandemic also encouraged several questionable practices. Some of these jewellers are now advertising and promoting their businesses in a misleading or deceptive manner.

For example, Jeweller has observed many examples of new businesses without storefronts marketed as having showrooms in all or many of Australia’s capital cities.

The problem is that in many cases, these showrooms don’t exist; they are often ‘virtual offices’ with no staff, operated from a serviced office arrangement.

The business often lists the phone number of its head office or may have a local phone number, which is redirected, unbeknownst to the customer, who thinks they are dealing with an employee in their city.

These businesses will offer a virtual appointment with their ‘highly specialised jewellers’ based in the head office. In other words, the ‘interstate showroom’ is nothing but a digital facade!

The trend is more evident post-COVID because technology has dramatically improved in the past few years, and consumers have become accustomed to not visiting stores.

With CBD rents crashing during the pandemic, establishing the ‘appearance’ of a jewellery showroom in other capital cities has become less expensive.

This facade is suitable for jewellery as it is a high- margin product.

In other words, the additional cost of renting a small interstate office, either as a physical location or a serviced office, could be far outweighed by the sale of a single piece of fine jewellery.

Closing remarks

With lockdowns in place and jewellery stores across much of Australia closed for the better part of two years, many jewellers were forced to alter their business to make ends meet.

The COVID-19 pandemic and the rise of social media as a viable avenue for business acted as a ‘one-two punch’ for the jewellery trade, working hand- in-hand to change the nature of the industry’s peripheral figures.

While the trading conditions of the pandemic forced change upon businesses with physical stores, and a lack of employment opportunities encouraged others to take the leap into jewellery for the first time, the common denominator was always the internet.

Research by IBM Data has suggested the pandemic accelerated this shift to e-commerce by around five years. This has forced retailers to rethink their operations quickly.

The emergence of ‘click and collect’ services is one of many examples. Consumer demographics and shopping behaviour also changed significantly.

Older consumers embraced online shopping during the pandemic, and these habits have continued despite its conclusion.

These changes are not only reflected in the jewellery industry; many retailers have transformed the layouts of their stores to reflect new consumer expectations.

When we think of a traditional map of the jewellery industry, we naturally focus on the relationship between suppliers/wholesalers and retailers, whether independent or chain stores.

The landscape has changed significantly for retailers operating without a storefront in recent years. Following the pandemic, this model is more viable than ever, driven by increased consumer access via social media and the internet.

The success of these Retailer – No Storefront businesses during and following the pandemic is also another timely reminder that the observation of store closures is not a ‘red flag’ for the wider industry.

Just as trends come and go, so do jewellery businesses and stores. As long as consumer interest in jewellery and watch products remains high, there's little cause for concern - despite the decline in independent stores.

Alternatively, if consumer sales do not decrease while a significant number of stores closed, it could be argued that it creates a healthier industry – the same revenue is divided by fewer (stronger) businesses.

As has been said many times in the 2024 SOIR, everything is a matter of perspective.

STATE OF THE INDUSTRY REPORT ADDENDUM EXPLAINED This article is an addendum to the State of the Industry Report published in December 2023. The purpose of the six-month study into the Australian jewellery industry is two-fold – it’s a historical document offering an in-depth examination of the trade from which a glimpse of the future may be obtained. As is often the case with studies of this nature, the research often uncovers unexpected insights. These include significant changes due to advances in technology, the evolution of consumer habits and expectations, and the unforeseen impact of an unprecedented global pandemic. In some cases, the space allocated to specific sections of the report was insufficient because of the additional detail and information obtained. This article is one such case where it was noted that the decline of independent jewellery retailers in Queensland far exceeded declines in other states. This was deemed worthy of further analysis. There is a host of additional information uncovered during the SOIR research period, which was also unable to be included in the initial report due to space and time limitations. Jeweller will continue to publish addendums to the SOIR to analyse and clarify an ever-changing industry. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES