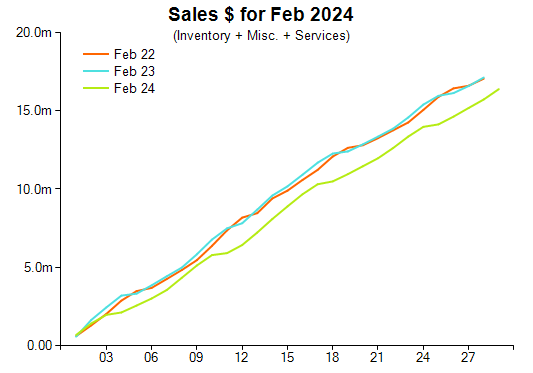

The data was compiled from more than 400 independent stores in Australia and published by Retail Edge Consultants, detailing a 4.3 per cent decline in overall sales dollar performance on a year-on-year comparison.

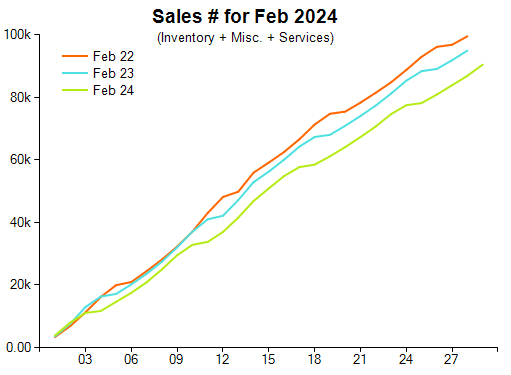

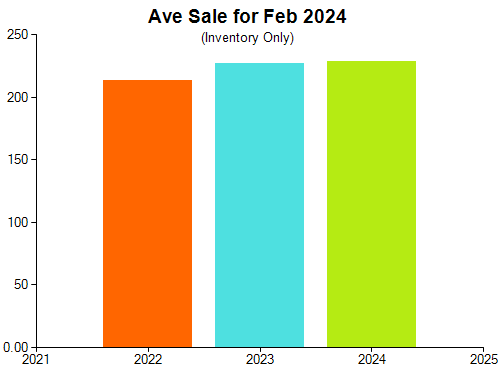

Comparative unit sales declined by 4.7 per cent compared with February 2023. The comparative average sale (inventory only) was effectively flat, at $228 compared with $227 the year prior.

Retail Edge general manager Leon van Megen said the latest results indicated that sales are returning to a degree of ‘normalcy’ following the impact of the global pandemic.

“When we measure against any month in 2022 and the early part of 2023, we are comparing to what appears to have been the ‘COVID-19 bubble’,” he told Jeweller.

“As we work our way into more directly comparable periods, we expect to see sales to come broadly in line with the last ‘non-COVID’ time period. And that is what we see this month: a gap in sales that has reduced compared with prior years.”

Diamond-set jewellery declined by 10 per cent on a year-on-year comparison, with van Megen suggesting that this is an established trend and that managing stock is vital.

Gemstone-set metal jewellery decreased by 7 per cent compared with 2023 and 14 per cent compared with 2022. Silver and alternative metal jewellery decreased by 4.7 per cent, while jewellery without a gemstone or diamond decreased by 7 per cent.

Van Megen added: “To avoid a cashflow squeeze, manage your aged stock aggressively, and buy well.”

Laybys decreased by 9.6 per cent in dollar terms between new orders and pickups and cancellations. Services decreased by 32.1 per cent, while special orders increased by 1.8 per cent.

The report found that 28 per cent of sales lines were discounted.

2024 Jewellery Retail Sales February Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Pleasing trends in jewellery sales ahead of holiday season

Silver linings in latest Australian jewellery market analysis

Australian jewellery retailers wrestling with decreasing sales

Tough sledding: Australian jewellery sales decline in August

Jewellery sales decline in July, consumer confidence on the rebound

Cause for celebration for jewellery retailers

Retail Edge urges caution in the latest market assessment

Weakened sales headlines April for jewellery retailers

Modest sales wins for Australian jewellery retailers

Surprise reversal pattern observed in Australian jewellery sales